BCE - Process Year End

Introduction

This a general guide to the BCE end of year process.

Most businesses follow a number of accounting activities at year end where there is a requirement to agree and complete their accounts to produce year end reports for their stakeholders.

A financial year-end report ensures a company pays the right amount of tax and provides shareholders with accurate information about the company.

Whilst BCE does not support a year-end tax return, it does provide the tools, using a combination of standard reports, custom reports and Excel functions to help users access and report on the information required.

In conjunction with the year-end reporting requirements, an 'End of Year' process is run to clear down the trading Profit & Loss section of the chart of accounts for the financial year to be closed.

Process Year End Overview

The BCE end of year process provides:

The ability to run an 'End of Year Audit Report' to show the Profit & Loss values.

Following any end of year financial adjustments, the 'End of Year Audit Report' can be rerun and saved to provide a full audit of the Profit & Loss balances before running the year end.

When the 'PROCESS YEAR END' is run all Profit & Loss expense and revenue account balances for the selected financial year are journaled to:

- The 'Brought Forward P&L' account (BRWPNL) in the Balance Sheet for BCE companies setup with Company setting ‘Incorporated’ ticked.

- The 'Drawings' account (DRAWNH) in the Balance Sheet for BCE companies setup with Company setting ‘Incorporated’ not ticked.

End of Year Audit Report

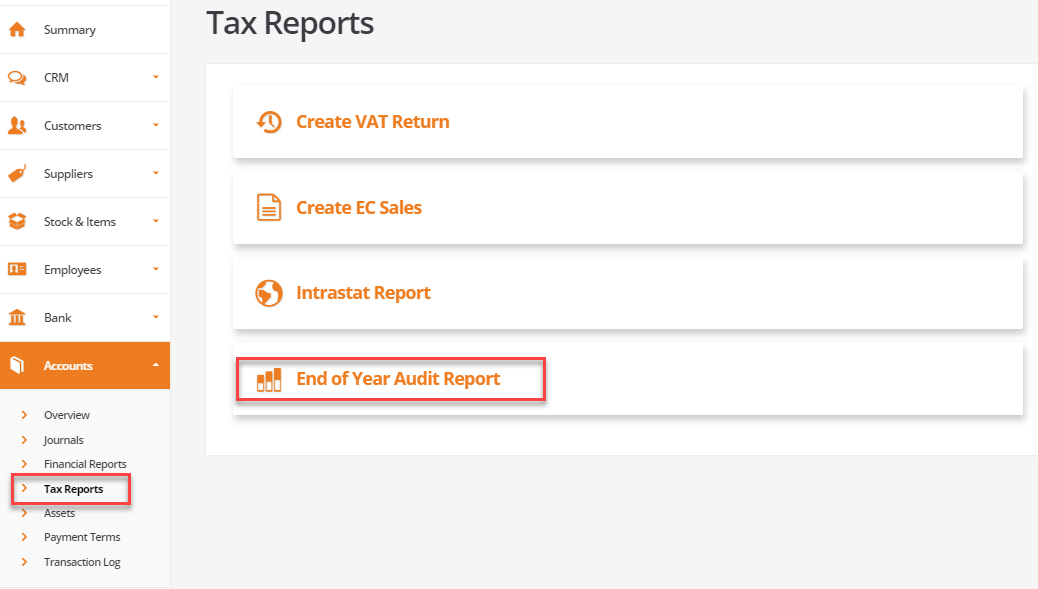

The end of year process is run from, 'Accounts', by selecting 'Tax Reports' and choosing the option 'End of Year Audit Report':

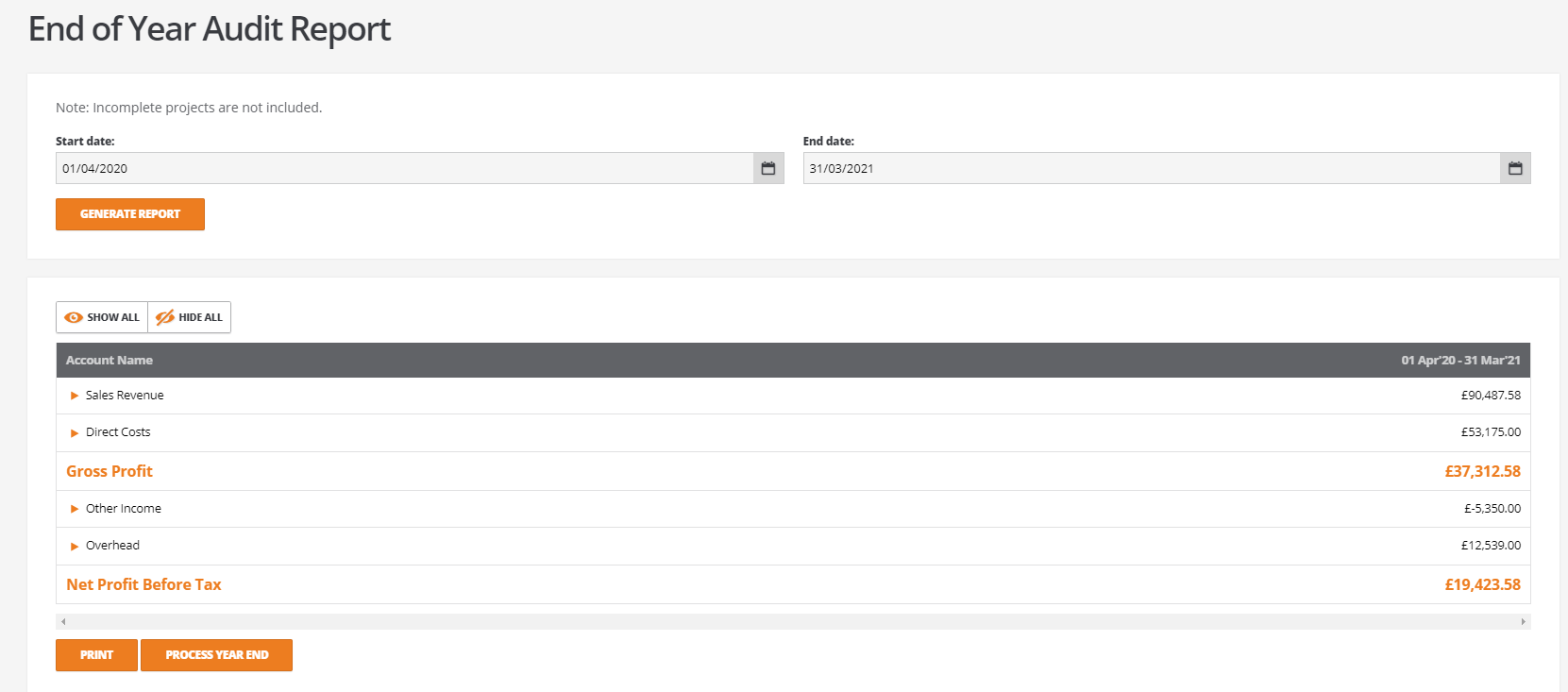

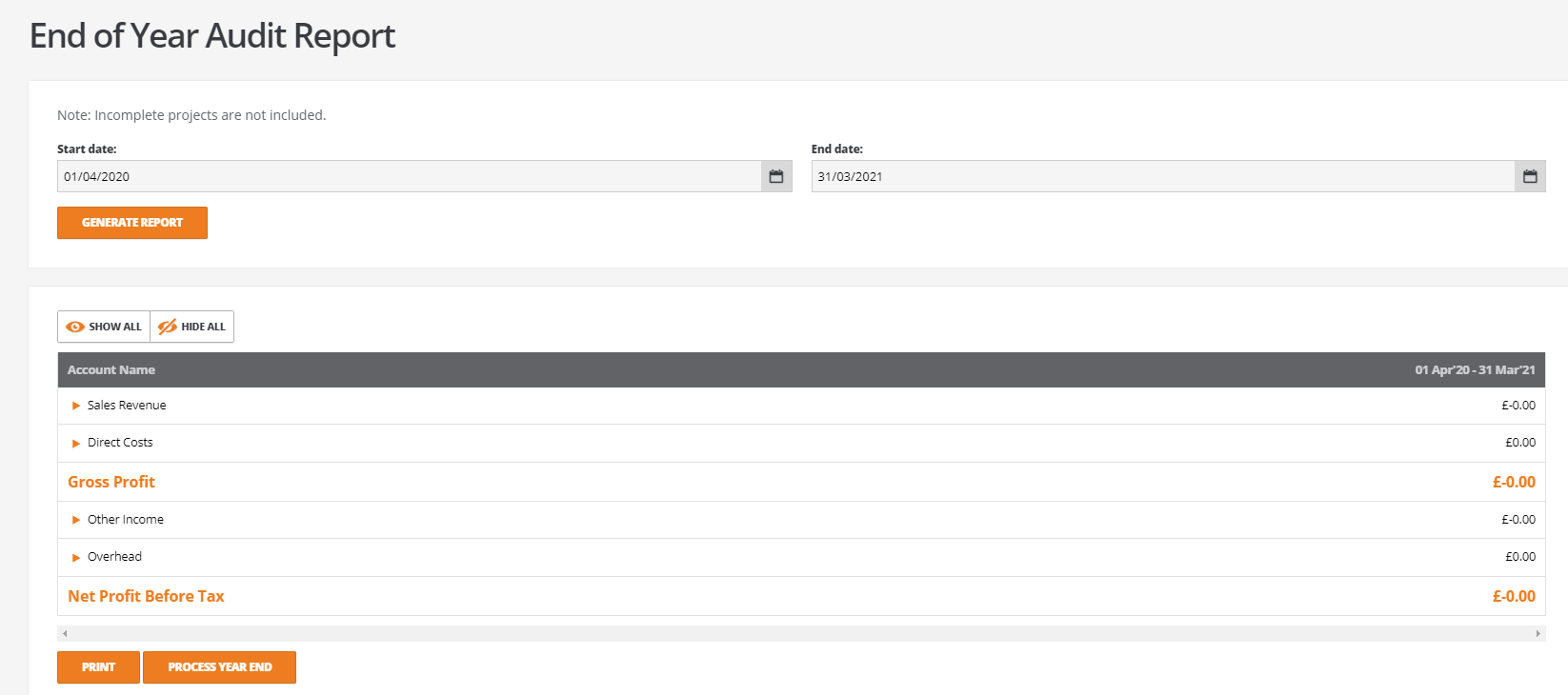

The 'End of Year Audit Report' opens and will default to the current financial year:

The report displays a summary of the Profit & Loss accounts with options to partially or fully expand the accounts.

The 'End of Year Audit Report' allows users to inspect and validate the values in the Profit & Loss before committing to closing the financial year.

When ready to run the end of year process, use the 'SHOW ALL' option to fully expand all Profit & Loss accounts. The 'End of Year Audit Report' can be printed and stored as part of the year end activities.

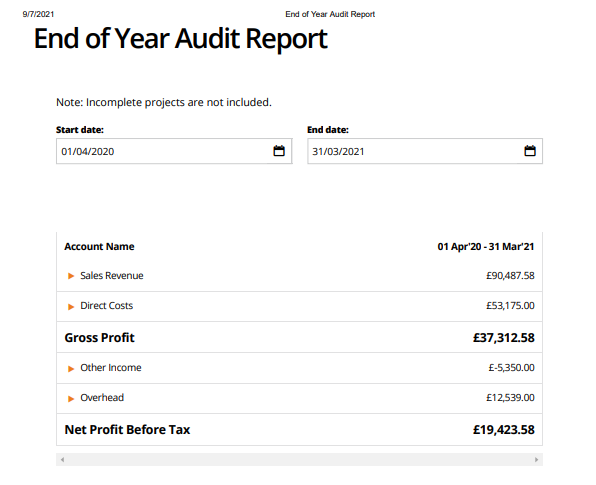

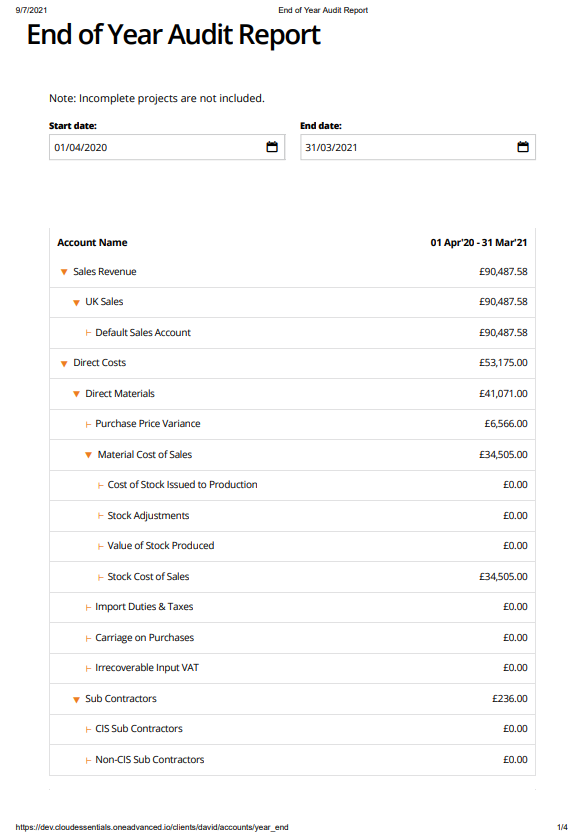

Note: The print option will generate a report relative to the detail that is displayed on screen. Therefore, to print a full 'End of Year Audit Report' use the 'SHOW ALL' option to display every revenue and expense account before printing:

Summary report:

Fully expanded report:

Processing the Year End

To close the year, click on 'PROCESS YEAR END' from the 'End of Year Audit Report'.

BCE prompts the user with the following warning message:

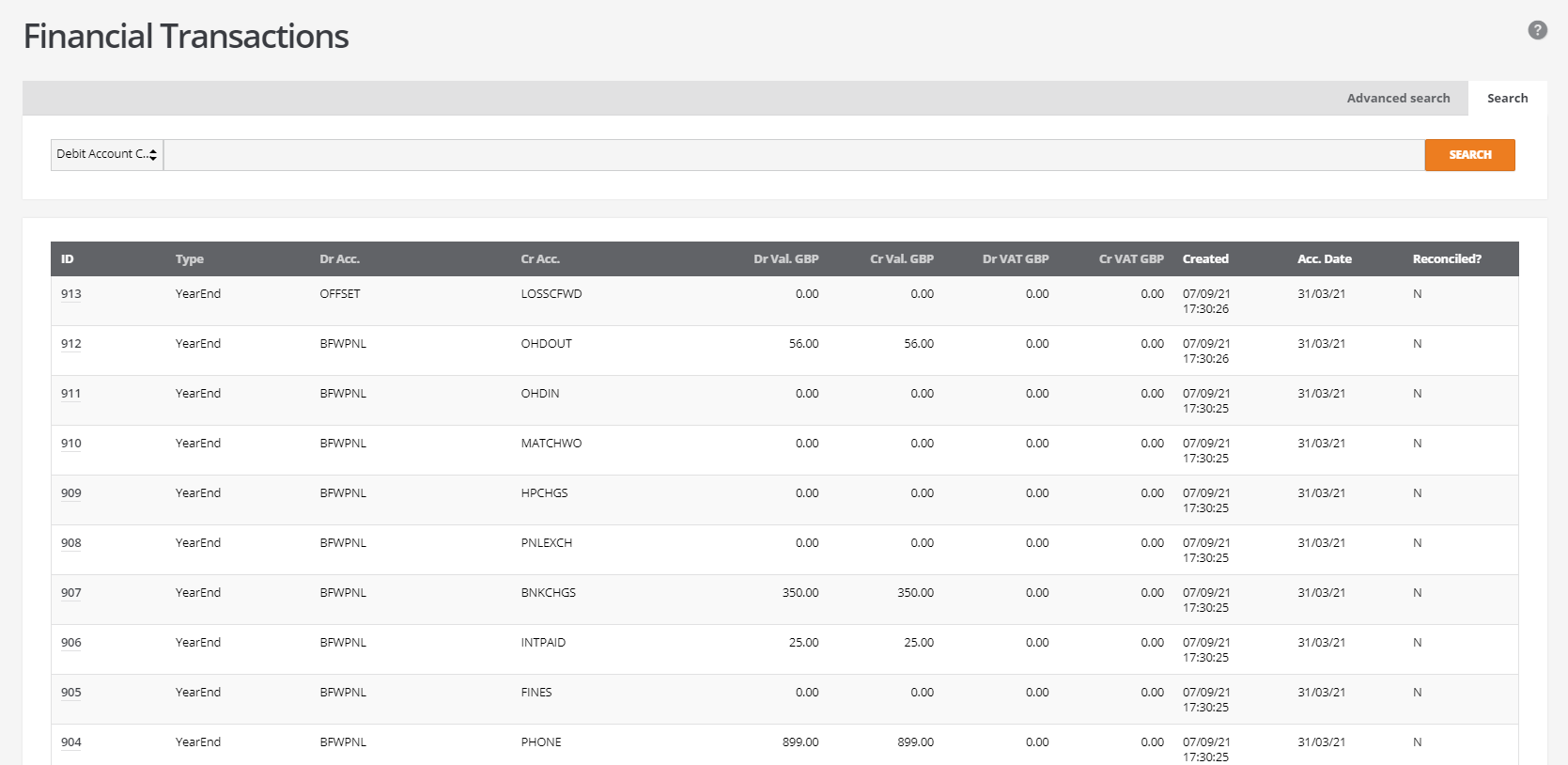

The end of year process creates individual journal lines of 'YearEnd' type for every Profit & Loss account regardless of the account balance:

Following the end of year process:

Rerunning the End of Year Audit Report for the closed year will return no values.

A backdated Trial Balance report will shows no Profit and Loss entries as they have been journaled to the balance sheet.

A backdated Profit and Loss report will continue to display the posted values for the closed year.

Notes:

On completing a financial year, it is good practice to close the associated financial periods for the year to prevent further documents from being created and posted to a closed or audited financial year.

If an 'End of Year Audit Report' is rerun for a past (closed) financial year, the report should be expected to return zero values:

If any documents have been posted to a closed year where their financial periods have remained open, then the 'End of Year Audit Report' will display the balance of documents created since the year end was first run.

This will require the financial year to be closed again to clear down the Profit & Loss accounts.