CIS - Domestic Reverse Charge VAT

CIS - Domestic Reverse Charge VAT

This is a reporting solution to permit users to account for the CIS Domestic Reverse Charge VAT

This article covers the following roles and processes:

- Introduction to CIS Reverse Charge VAT

- BCE CIS Roles

- As a contractor, how to enter purchase invoices for sub-contractors and account for reverse charge VAT

- As an 'End User' contractor, how to enter purchase invoices for sub-contractors

- 5% Disregard Rule

- As a sub-contractor, how to prepare sales invoices for your contractor

- CIS Input/Output VAT Analysis Custom Report

- Completing the VAT Return

Introduction to CIS Reverse Charge VAT

From 1 March 2021 HMRC introduced changes for reporting the VAT for contractor and sub-contractors invoices:

For VAT registered CIS Sub-Contractors who supply service and related goods purchase invoices, they will no longer account for their output VAT.

The Contractor is now required to account for Sub-Contractor’s output VAT as well as their own input VAT.

This policy is referred to as Domestic CIS Reverse Charge VAT which means the output VAT on a sub-contractors sales invoice is passed to the contractor who records and accounts for both the input and output VAT on purchase invoices on their VAT report.

The changes are isolated to VAT and there are no changes in respect of the deduction and reporting of CIS tax, CIS discounts or CIS retentions.

HMRC state if there is any 'reverse charge element' in a supply then the whole supply shall be subject to the reverse charge policy.

This means:

A sub-contractor may supply a purchase invoice for either; services only, materials only or services and materials (mixed supply).

- A purchase invoice for services (labour) only is subject to the CIS deduction of income tax and the reverse charge VAT will apply.

- A purchase invoice for materials only is not subject to CIS deduction of income tax and is therefore not subject to the reverse charge VAT.

- A purchase invoice for services (labour) and materials (mixed supply) is subject to the CIS deduction of income tax and the reverse charge VAT will apply.

This policy simplifies the reporting process for both contractor and sub-contractor and avoids the need to apportion their supplies.

If both the contractor and sub-contractor agree, any subsequent supplies on that site between the same parties can be treated as domestic reverse charge supplies. This should reduce doubt and speed up the decision making process for both parties.

If still in doubt, provided the recipient is VAT registered and payments are subject to CIS, it is recommended that the reverse charge should apply.

HMRC reference:

https://www.gov.uk/guidance/vat-domestic-reverse-charge-for-building-and-construction-services

BCE CIS Roles

A BCE user can act in the role of a contractor, an 'End User' contractor or a sub-contractor or all three.

- As a contractor, they will need to apply the reverse charge VAT for VAT registered sub-contractors.

- As a contractor, and where classified as an ‘End User’, (consumer of the services and materials), the reverse charge VAT policy does not apply.

- As a sub-contractor, there is a requirement to use appropriate messaging to their contractor/s on sales invoices.

As a Contractor

When adding purchase invoices and credit for VAT sub-contractors dated from 1 March 2021, the user shall need to determine if the domestic reverse charge VAT applies.

If reverse charge VAT applies to the purchase invoice or credit the document lines should be entered with the net value and all calculated VAT values entered as 0.00.

The sub-contactor should have indicated that their invoice is subject to reverse charge VAT and this may include the VAT values and VAT rates that would have been applied.

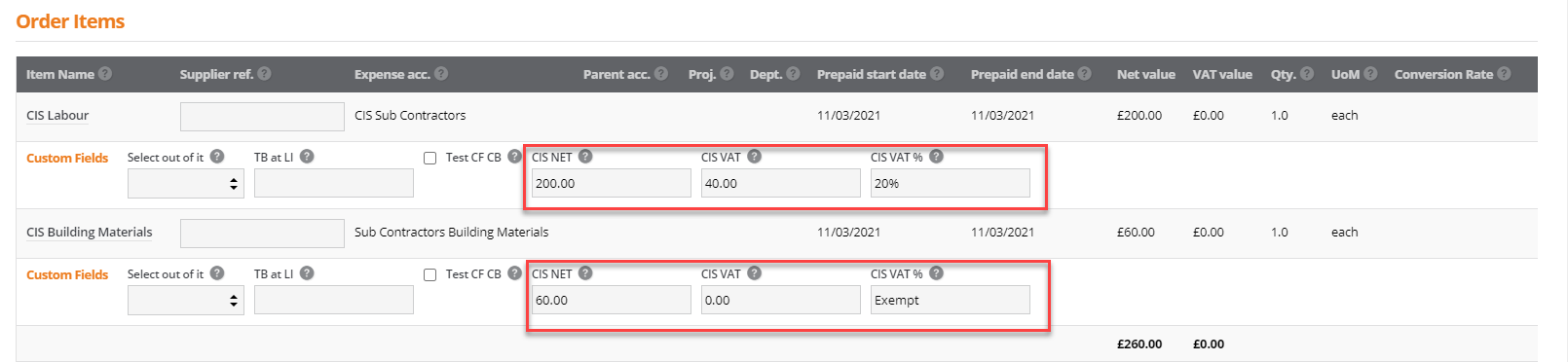

To accommodate the VAT analysis for reverse charge, BCE users are advised to create purchase line custom fields to record the following details for each document line:

- Net value of the invoice line

- The value of VAT of the invoice line that would have ben applied if it had not been subjected to reverse charge

- The VAT Rate % for the invoice line that would have ben applied if it had not been subjected to reverse charge

When the VAT report is run the net value of the CIS purchase invoice is recorded in box 7 but no value will be automatically recorded in box 4 for the input tax.

A custom report will be used to list all CIS purchase invoices and VAT from the values recorded on the purchase line custom fields.

Purchase invoices entered for *CIS sub-contractors can be identified from the suppliers account 'CIS Rate' value which should contain a value for tax deduction.

The sum of the VAT for all purchase invoices and credited shall represent the sum of the input VAT and the corresponding domestic reverse charge output VAT values to be adjusted on the VAT report before submitting to the Business Tax Portal.

Notes:

Line based custom fields can be edited provided the purchase Invoice or credit has not been fully paid.

* Where sales invoices are supplied by non CIS sub-contractors, if the invoice includes goods that are deemed to be subject CIS reverse charge, then an alternative method of invoice identification shall be required as the suppliers sub contractor tax rate will not be applicable. The use of a document header 'CIS Reverse Charge VAT' field can be considered for the compilation of a custom report.

As an 'End User' Contractor

The reverse charge policy does not apply to end user purchase invoices. Purchase Invoices for sub-contractors are created in BCE using the VAT rates supplied on sub-contractors sales invoice.

5% Disregard Rule

The reverse charge policy does not apply to purchase invoices where the CIS element is 5% or less that the materials supplied. Purchase Invoices for sub-contractors can be created using the VAT rates supplied on the invoice.

As a Sub-Contractor

When adding contractors invoices as a BCE sales invoices, if the content is subject to contractors reverse charge, the receiving contractor needs to be informed using the recommended messaging on the sales invoice.

If the sales invoice is subject to contractors reverse charge, the VAT rate will need to be changed to 'Exempt'.

The sales invoice should be printed to a custom document template named 'CIS - Sales Invoice subject to Reverse Charge' that shall contain the appropriate messaging to the contractor.

Messaging on Sales Invoices

This applies to BCE users acting as sub-contractors where their sales invoices must include the wording and VAT values.

HMRC have provided the following recommendations:

When supplying a service subject to the domestic reverse charge, suppliers must:

- Show all the information required on a VAT invoice

- Make a note on the invoice to make it clear that the domestic reverse charge applies and that the customer is required to account for the VAT

- Clearly state how much VAT is due under the reverse charge, or the rate of VAT if the VAT amount cannot be shown, but the VAT should not be included in the amount charged to the customer

The VAT regulations 1995 say invoices for services subject to the reverse charge must include the reference ‘reverse charge’.

Examples of wording that meet the legal requirement:

- Reverse charge: VAT Act 1994 Section 55A applies

- Reverse charge: S55A VATA 94 applies

- Reverse charge: Customer to pay the VAT to HMRC

As BCE is unable to show the reverse charge VAT values you must:

- State that the VAT is to be accounted by the customer

- Add wording to the invoice to say ‘customer to account to HMRC’ for the reverse charge

- Make sure customer can identify reverse charge goods or services

CIS Input/Output VAT Analysis Custom Report

To retrospectively analyse input/output VAT values will be difficult from a full list of purchase invoices and credits for the VAT reporting period.

It is recommended to use purchase line custom fields to record purchase line 'NET', 'VAT' and VAT rate values to allow this analysis to be conducted more efficiently.

Custom fields can be introduced and easily edited allowing users to manage the values for each CIS purchase document line.

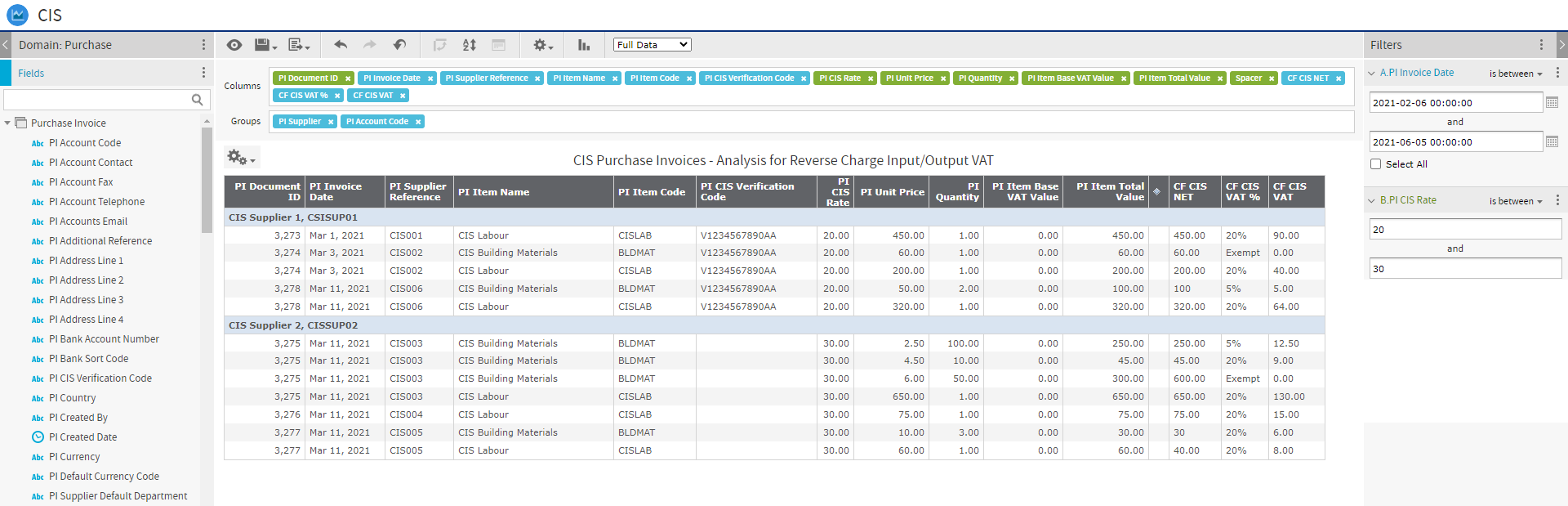

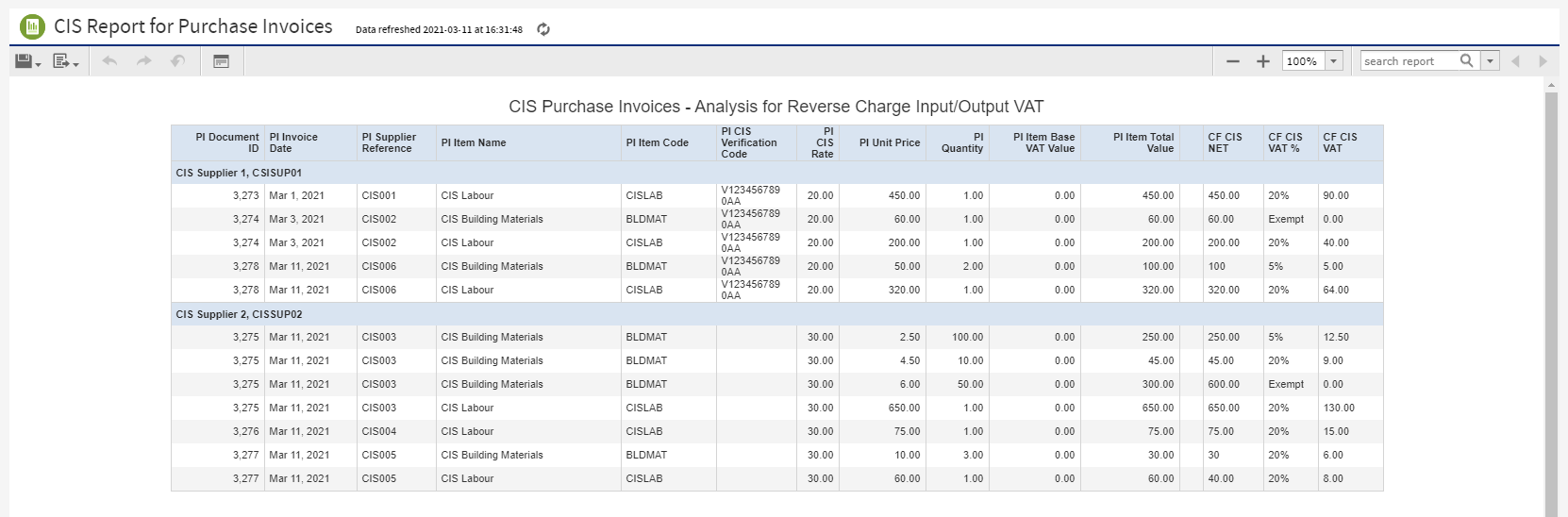

A custom report is provided to list all CIS type purchase documents and to identify the correct input VAT and therefore the corresponding reverse charge output VAT values required for CIS reverse charge from the completed custom fields.

The resulting report lists all CIS purchase invoices by sub-contractor recording their verification number and details on each purchase invoice line.

The contents of the custom fields will validate each purchase the line net value and display the corresponding VAT value and rate recorded at the time of the purchase invoice entry.

This report can be exported to Excel xlsx format and stored as supporting evidence for the changes made to the VAT report values in boxes 1 and 7 of the VAT return.

Completing the VAT Return

When completing the VAT return a manual adjustment will need to be made to the VAT values reported in boxes 1 and 4 before submitting to the Business Tax Portal.

CIS purchases invoices will already be included in:

- Box 7 Value of goods and services purchased

- Box 4 Zero value (As purchase invoice lines were set to 0.00 VAT)

A manual adjustment will need to be made to the VAT values reported in boxes 1 and 4 before submitting to the Business Tax Portal.

- Box 1 only Value of sub-contractor’s output VAT (Reverse Charge)

- Box 4 only Value of input VAT had it been reclaimed on Purchase Invoice

The reverse charge Input VAT adjusted in box 1 for the sub-contractors output tax and the contractors input tax in box 4 will be equal and will generate no VAT liability.