BCE - CIS Construction Industry Scheme

BCE - CIS Construction Industry Scheme

Introduction

This is a brief guide to how CIS is setup and works in BCE

The Construction Industry Scheme (CIS) is a tax deduction scheme to deduct sub-contactor tax at source from payments which relate to construction work.

HMRC Reference: https://www.gov.uk/what-is-the-construction-industry-scheme

CIS Setup

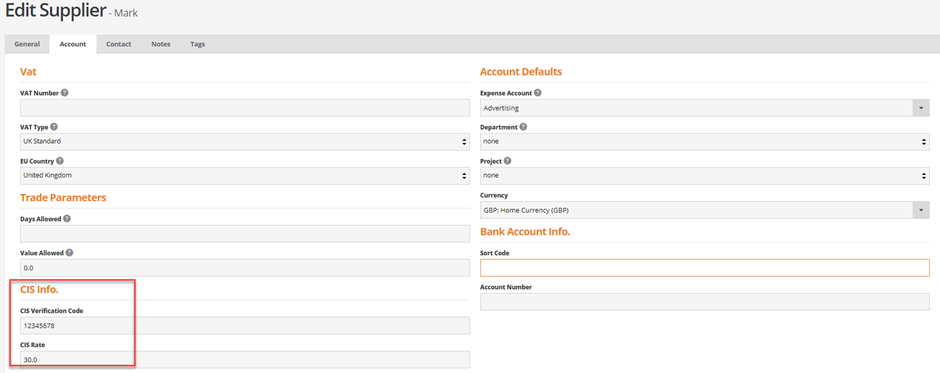

Suppliers

A supplier account is designated as a 'Sub-Contractor' by setting their:

- CIS Verification Code - Enter code supplied by HMRC

- CIS Rate - Enter the sub-contractors tax rate (% symbol is not required)

The Construction Industry Scheme (CIS) deduction rates are:

- 20% for registered subcontractors

- 30% for unregistered subcontractors

- 0% if the subcontractor has ‘gross payment’ status - for example they do not have deductions made

Note: The CIS verification code and rate is not validated with the HMRC

Stock and Order items

Consumable type stock items are setup and marked as CIS

For example:

Groundwork Materials – Consumable item

Edit stock items and check the status of the CIS tick box - Not ticked

Default Expense code account should be set to Subcontractors Materials

Groundworks – Consumable item

Edit and check the CIS tick box - Ticked

Default Expense code account should be set to CIS Sub Contractors

Projects

Using CIS

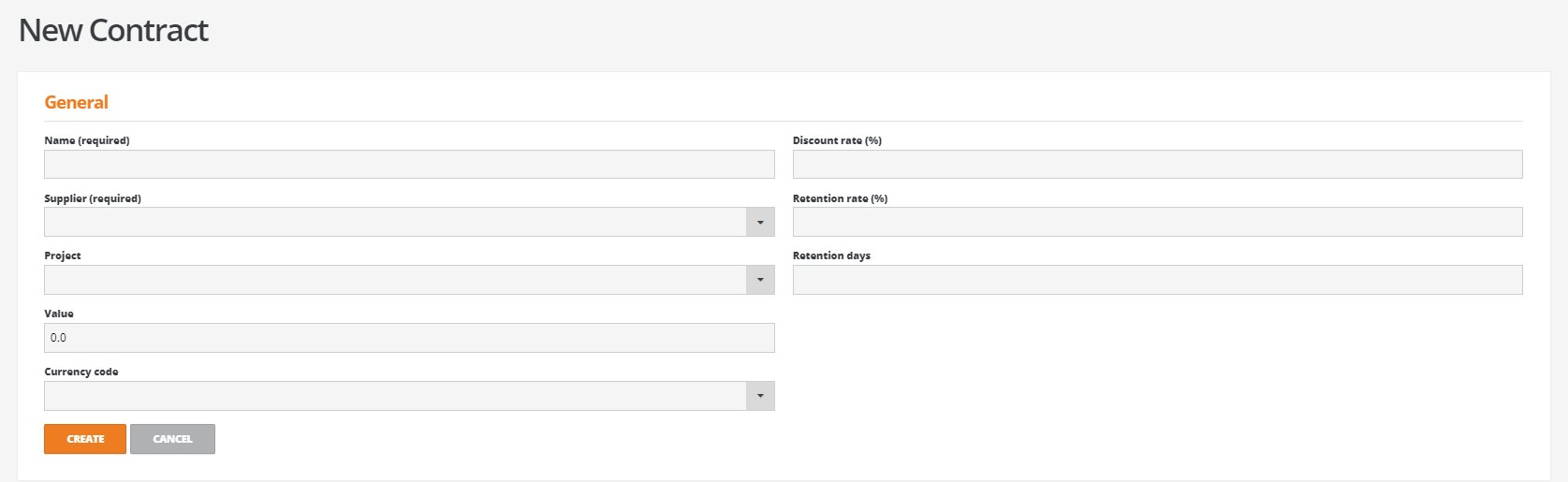

From Suppliers - Add New Contract:

Name - Add contract name or reference number

Supplier - Select the sub contractor supplier record from list of suppliers

Project - Select the Project from the list of Projects

Value - Value of Contract

Currency Code - Currency (GBP)

Contract Rules

Discount rate (%) - 3%

Retention rate (%) - 5%

Retention days - 365

Adding New Purchase Order for Sub-Contractor

Header

Select Supplier

Contract - Associate order with Contract attracts discount and retention rates

Line

Item name - Groundworks

Price - £5000 (labour)

Expense acc. - Populated by default CIS Sub Contractors

Project - Select Project code

Item name - #4121 (Groundworks Materials)

Price - £5000 (materials)

Project - left blank

Save and send order to supplier

As invoices are received from the sub contractor supplier

From Purchase order, select ‘Receive Invoice’

Header

Supplier Reference: Supplier Invoice Number

Invoice date: Enter date of invoice

Line

Labour

Qty - May have only partially completed contract (ie Ord Qty. = 1 inv Qty = 0.5)

Net Value - £2500.00

VAT - £500.00

Expense code - Carried over from order

Materials

Qty - Fully claimed (Ord Qty. = 1 inv Qty = 1)

Net Value - £5000.00

VAT - £1000.00

Expense code - Carried over from order

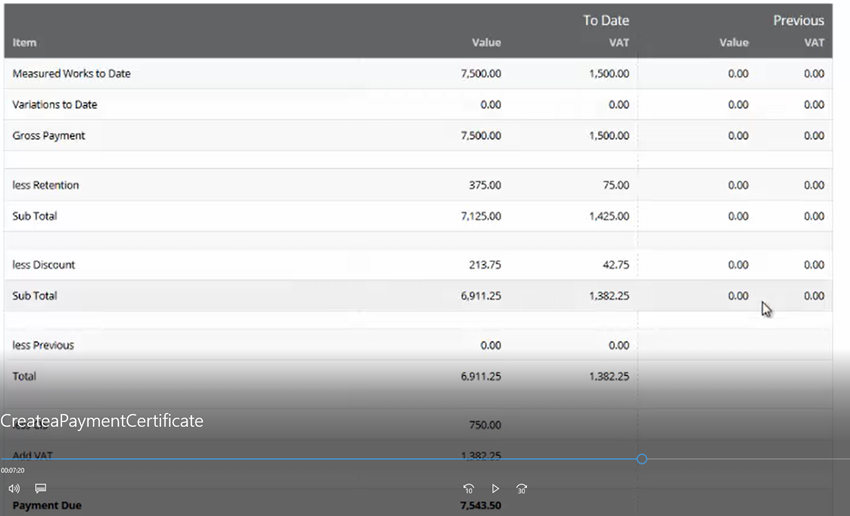

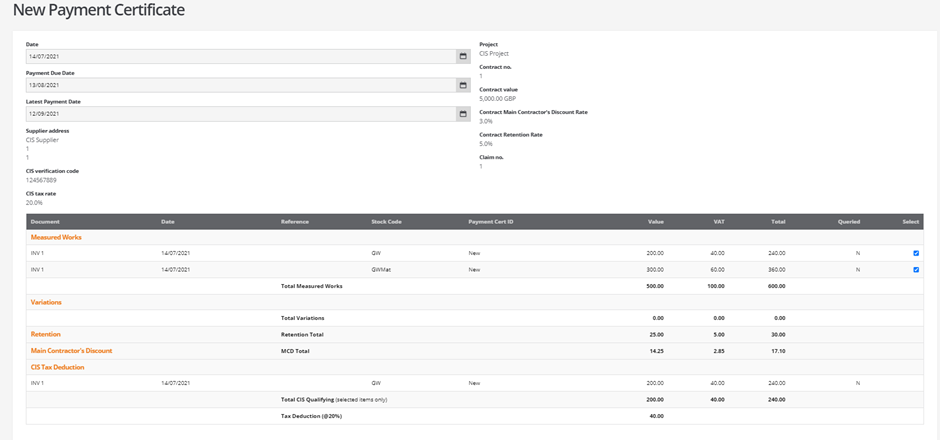

Payment Certificate

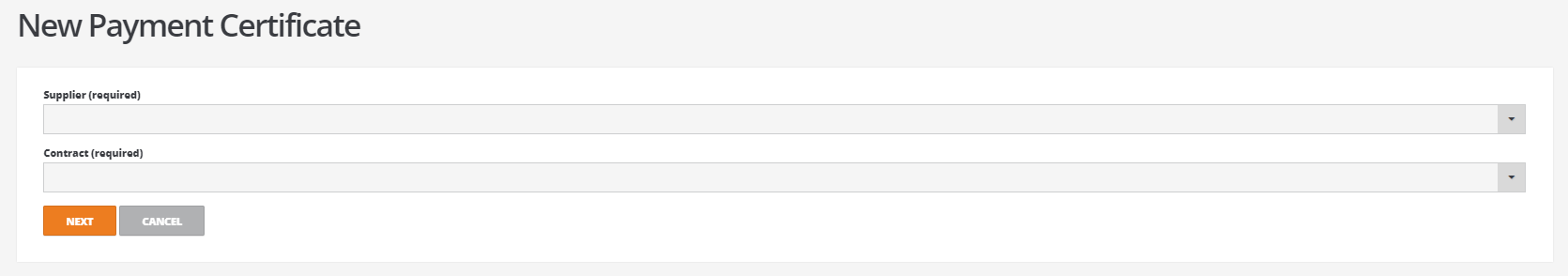

From Bank, select add new Payment Certificate:

New Certificate

Supplier - Select the supplier account

Contract - Only contracts that relate to the selected supplier are listed

NEXT

Date - Payment Certificate Date

Payment Due Date:

Latest Payment Date:

Screen lists contract details with ‘Claim no.

Invoices received are listed

Materials - £5000.00

Labour - £2500.00

Total measured Works - £7500.00

Less Retention (5%) - £375.00 (7500 * 3% = 375)

Less MCD (3%) - £213.75 ((500 – 375 = 7125) * 3% = 213.75)

Tax deduction

Sub Contractor 30% is applied to labour only

Total CIS Qualifying £2500

Tax Deduction (@30%) £750.00

Print Certificate and send or email to supplier

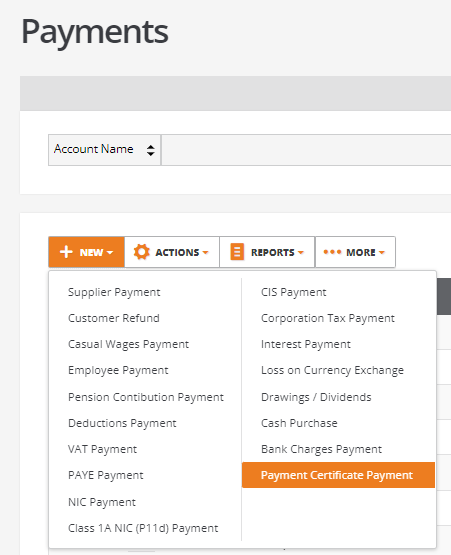

Pay Payment Certificate

From Bank

Select NEW

Payment Certificate Payment

Select Certificate from list

From - Enter Bank Account

Accounting Date

Amount - Auto populated from cert

Reference - Payment Method, ie BACS

Narrative - Add any notes as required

CREATE

Remaining Invoices

Any outstanding invoices from supplier for balance can be added:

For example, the remaining 50% of labour

Extras, overs and variations

Can be processed but not against the original Purchase Order

Add these are New Invoice (no Order/GRN)

Header

Supplier:

Supplier reference:

Date:

Contract:

Line

Item name - Groundworks (labour)

Price - £1000

VAT - £200

Qty - 1

Project - Project code

SAVE

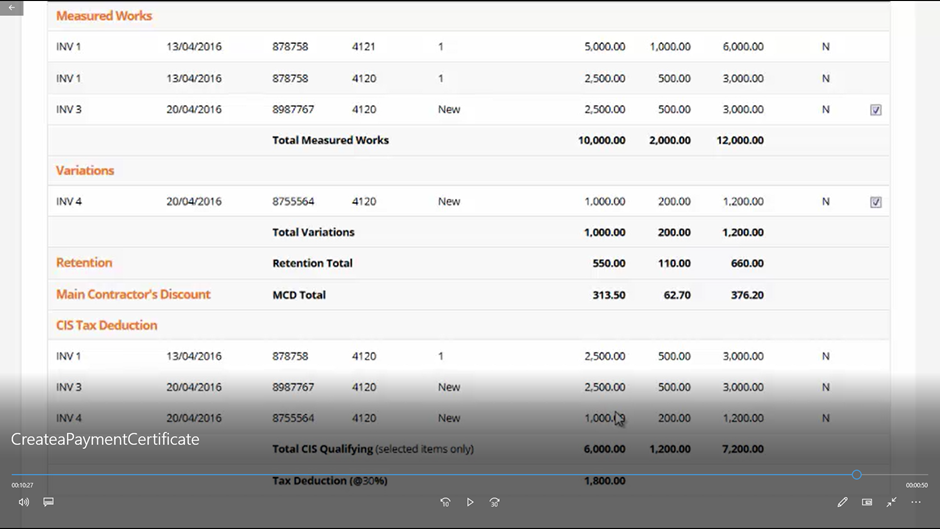

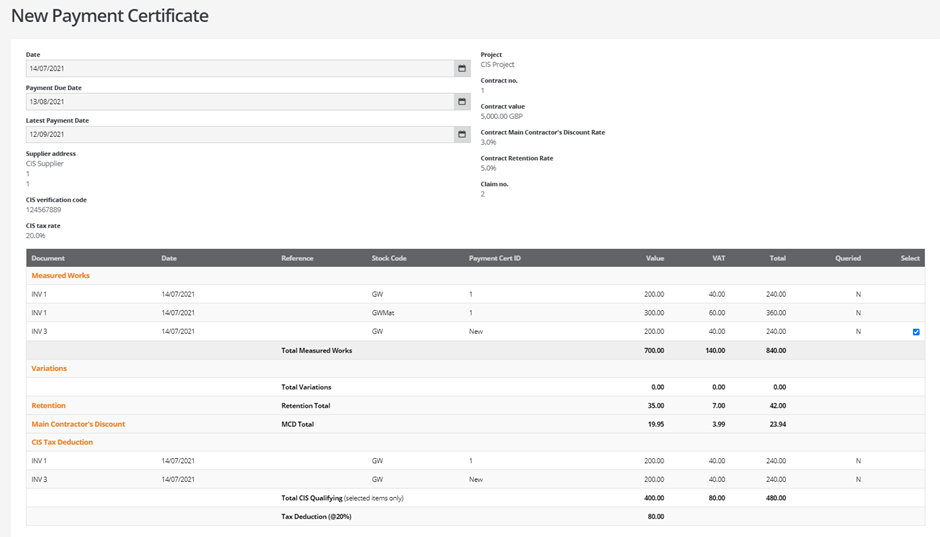

Create Payment Certificate

From Bank

Payment Certificates

New Certificate

Supplier:

Contract:

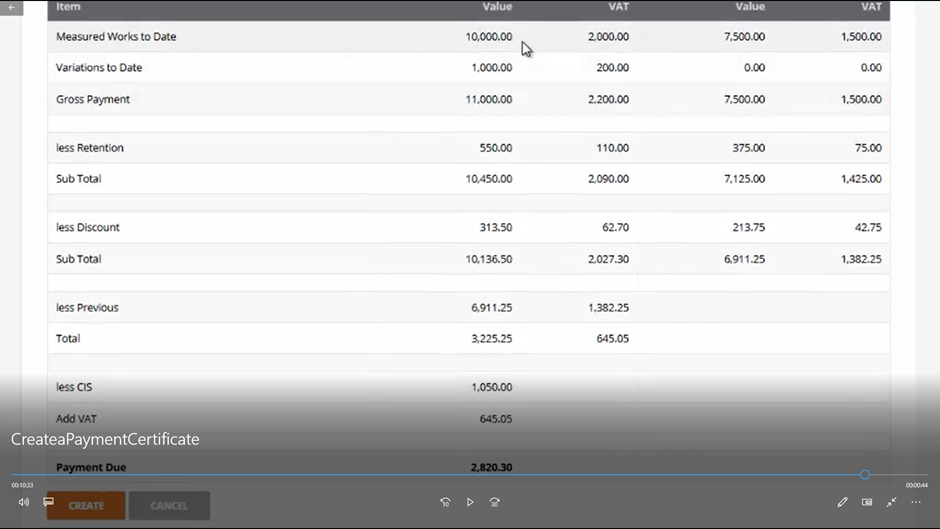

Screen shows

Measured Work - Balance of groundworks

Variation - Plus new items under Variations

Previous items already paid will show their payment certificates

Both new invoices, balance of labour and new labour both subject to 30% tax:

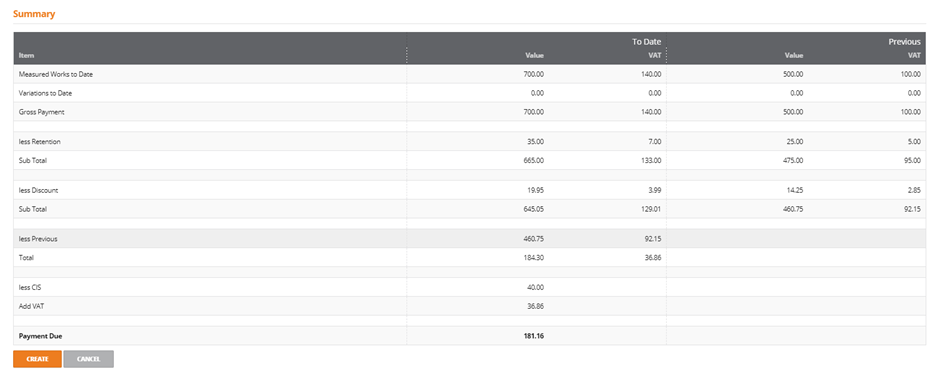

Covers original contract (measured works to date)

Plus any variations (extras)

Produces overall certificate showing deductions and tax

Less previous cert value

Create next payment certificate for supplier

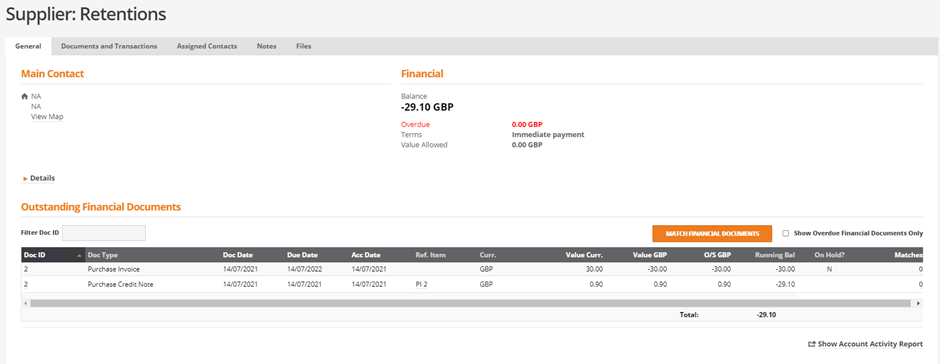

Retentions Financial Movements

For CIS, the retentions are posted to a reserved retentions supplier account and a reserved service type stock account.

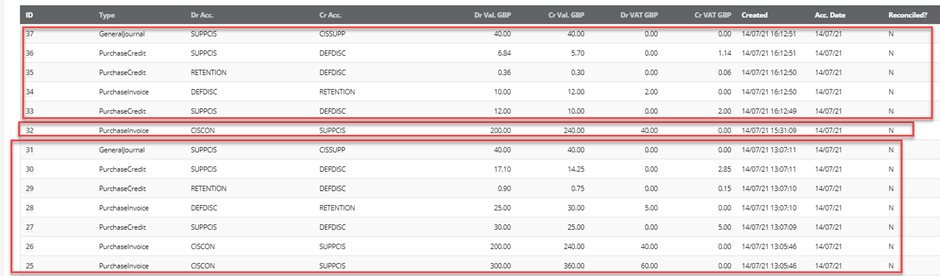

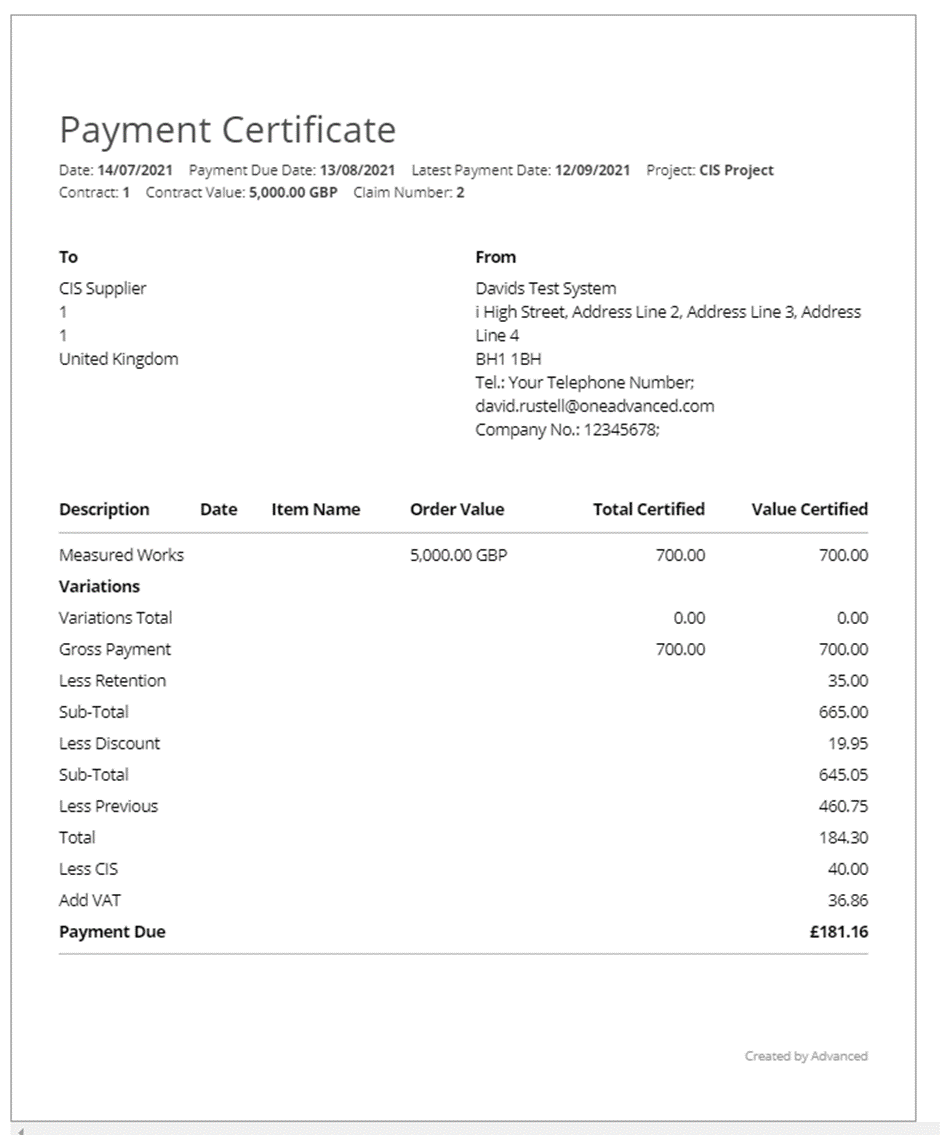

Example Payment Certificate

Example transaction line movements