VAT - UK Imports Postponed VAT Accounting

- Introduction

- Postponed VAT Accounting

- UK VAT Registered Businesses - to 31 December 2020

- UK VAT Registered Businesses – from 1 January 2021

- How PVA is applied in BCE

- Postponed VAT Accounting – System Settings

- Postponed VAT Accounting - VAT Calculation example:

- Monthly Postponed Import VAT Statement

- Postponed VAT Accounting – BCE VAT Schemes

- Standard VAT Invoice Accounting

- Cash Accounting VAT

- Flat Rate VAT

Introduction

UK businesses accounting for import VAT on their VAT return following the HMRC guidelines for ‘Postponed VAT Accounting’.

Prior to the UK’s exit from the European Union postponed VAT accounting applied to imports from the European Union only.

Following the UK’s exit from the European Union (Brexit), postponed VAT accounting changes were announced by the HMRC to account for all UK imports with effect from 1 January 2021.

In addition to reporting all UK imports, changes were applied to:

- The boxes to be completed on the VAT Return

- Separation of EU imports from non EU imports for UK businesses located in Northern Ireland (The Northern Ireland Protocol)

A pdf copy of these user notes can be downloaded from here

Postponed VAT Accounting

UK VAT Registered Businesses - to 31 December 2020

All UK businesses

For purchases of imported goods up to and including 31 December 2020, purchase invoices and purchase credit notes using VAT type ‘EU Import’ updated the following VAT Return boxes:

- Box 9: Imported acquisition value

- Box 7: Imported acquisition values included with all domestic purchases

- Box 4: Reclaimed VAT value (Relative to Stock VAT rate)

- Box 2: Postponed VAT due

UK VAT Registered Businesses – from 1 January 2021

For UK businesses not resident in Northern Ireland

From 1 January 2021, in accordance with the transition period following Brexit, the HMRC requirements for VAT registered businesses reporting postponed VAT accounting (PVA) on goods imported into the UK changed from reporting EU imports only to reporting all UK Imports.

For purchases of imported goods from 1 January 2021, purchase invoice and purchase credit notes using VAT types ‘EU Import’ and ‘Non EU Import’ update the following VAT Return boxes:

- Box 7: Imported acquisition value

- Box 4: Reclaimed VAT value (Relative to stock item VAT rate)

- Box 1: Postponed VAT due

For UK businesses resident in Northern Ireland

UK businesses resident in Northern Ireland are required to separate their EU imports from non EU imports.

This is known as the Northern Ireland Protocol where the VAT Return reporting requirements are:

For purchases of imported goods from 1 January 2021, purchase invoices and purchase credit notes using VAT type ‘EU Import’ continue to update the following VAT Return boxes:

- Box 9: Imported acquisition value

- Box 7: Imported acquisition values included with all domestic purchases

- Box 4: Reclaimed VAT value (Relative to stock item VAT rate)

- Box 2: Postponed VAT due

For purchases of imported goods from 1 January 2021 purchase invoice and purchase credit notes using VAT type ‘Non EU Import’ update the following VAT Return boxes:

- Box 7: Imported acquisition value

- Box 4: Reclaimed VAT value (Relative to stock item VAT rate)

- Box 1: Postponed VAT due

For HMRC reference see:

https://www.gov.uk/guidance/complete-your-vat-return-to-account-for-import-vat

How PVA is applied in BCE

UK businesses accounting for import VAT on their VAT return following the HMRC guidelines for ‘Postponed VAT Accounting’.

Prior to the UK’s exit from the European Union the requirement was to report imports from the European Union only.

From 1 January 2021, following the UK’s exit from the European Union (Brexit), this requirement changed to report all UK imports.

HMRC require businesses to report, a value of input VAT as if the transaction had been conducted within UK shores. (A notional VAT calculation) Therefore the VAT calculated for PVA respects the VAT rate stored on the stock item.

VAT is both declared and reclaimed on the same VAT return meaning there is no actual VAT liability.

Postponed VAT Accounting is not concerned with any sales activities.

Postponed VAT Accounting – System Settings

By default BCE identifies UK imports by the use of VAT types ‘UK Imports’ and ‘non UK Imports’ on documents.

For UK businesses not resident in Northern Ireland, all imports will be reported and consolidated as required by HMRC on the VAT return.

- EU imports dated before 1 January 2021 will update VAT return boxes 9, 7, 4 and 2.

- UK imports dated on and after 1 January 2021 will update VAT return boxes 7, 4 and 1.

For UK businesses resident in Northern Ireland, HMRC require EU imports to be reported separately from non EU imports where:

- EU Imports shall continue to update VAT return boxes 9, 7, 4 and 2.

- Non UK imports dated on and after 1 January 2021 will update VAT return boxes 7, 4 and 1.

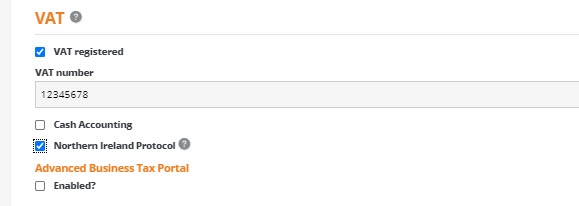

To enable the ‘Northern Ireland Protocol’ the following system setting must be selected from, the ‘Tax and Payroll’ tab in ‘Company Settings’:

Postponed VAT Accounting - VAT Calculation example:

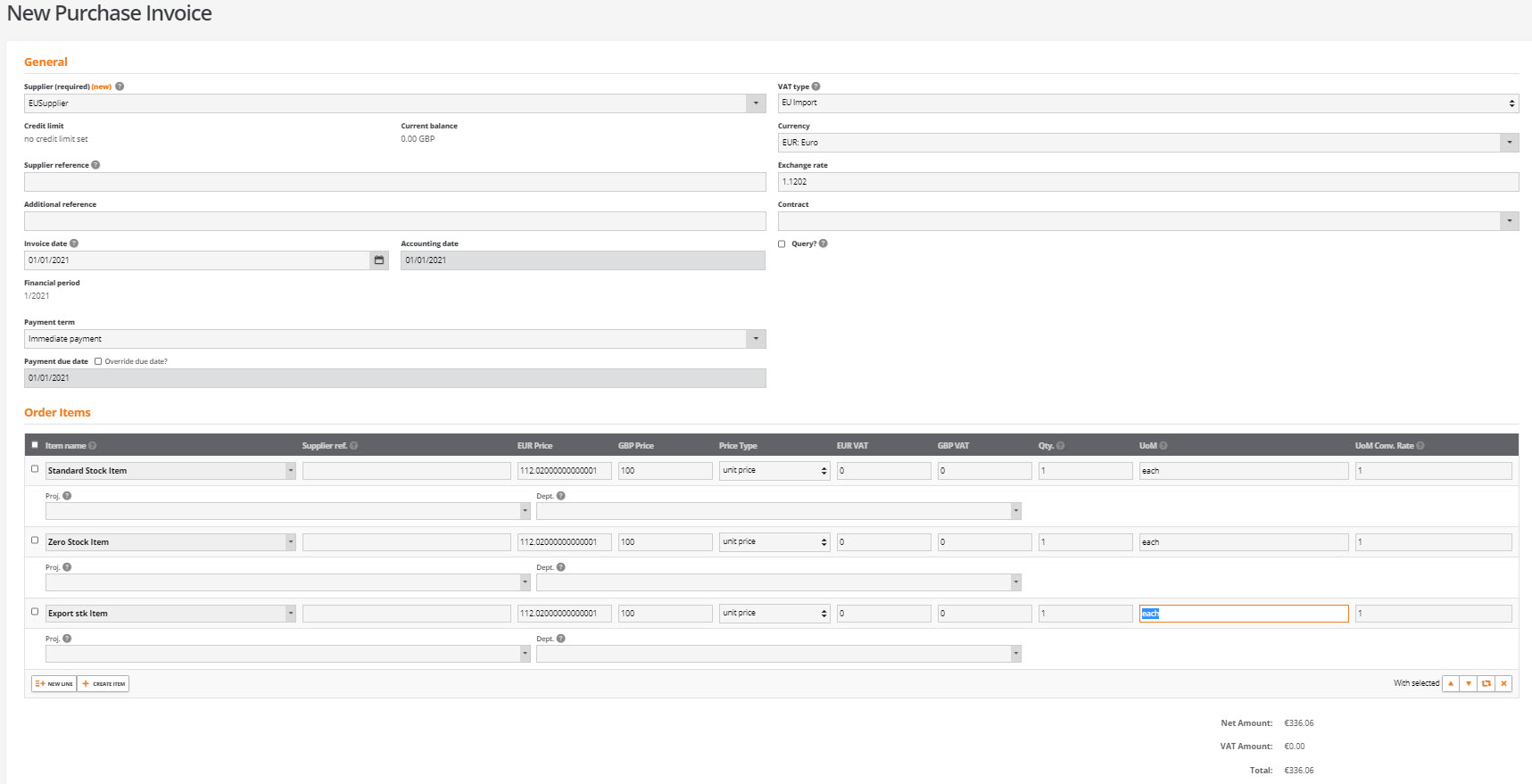

A UK import purchase invoice is created containing three stock lines in currency that when converted to base are for £100.00 each where:

· Line 1 stock item is standard rate

· Line 2 stock item is zero rate

· Line 3 stock item is exempt rate

The total net value of the purchase invoice consolidated to base is £300.00.

If this had been a domestic UK purchase document, the VAT for line 1 would have been calculated at 20% standard VAT rate. Lines 2 and 3 are zero and exempt rate and no VAT value is calculated.

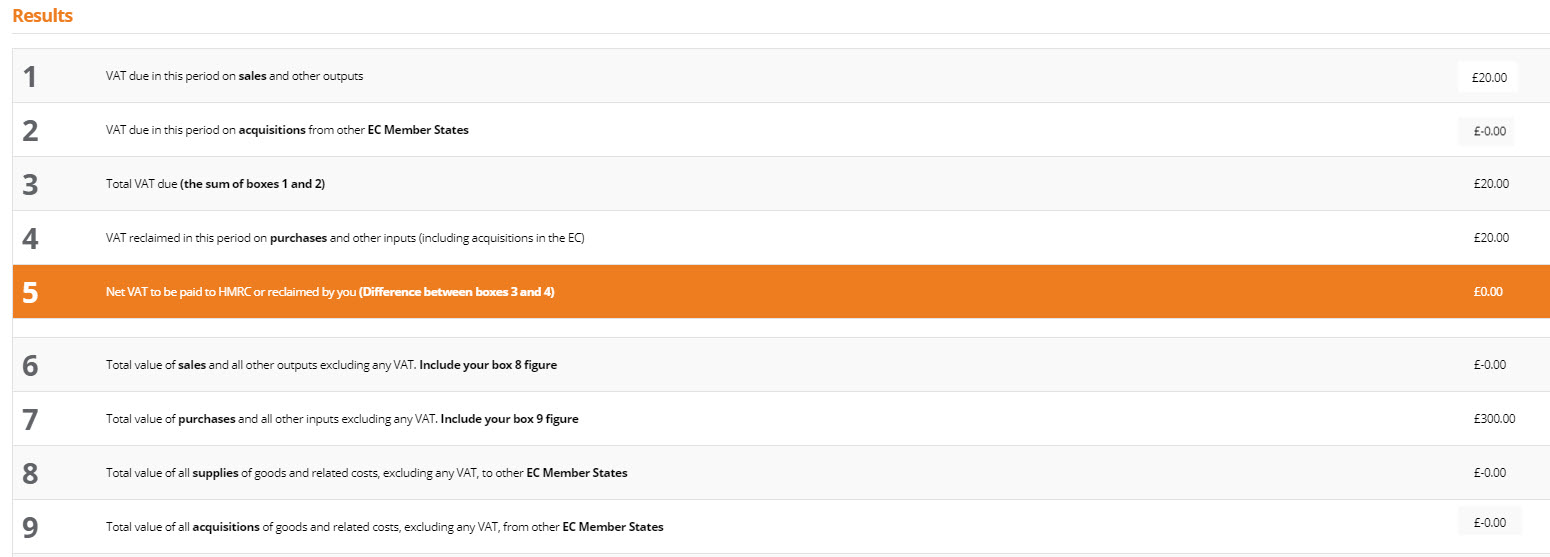

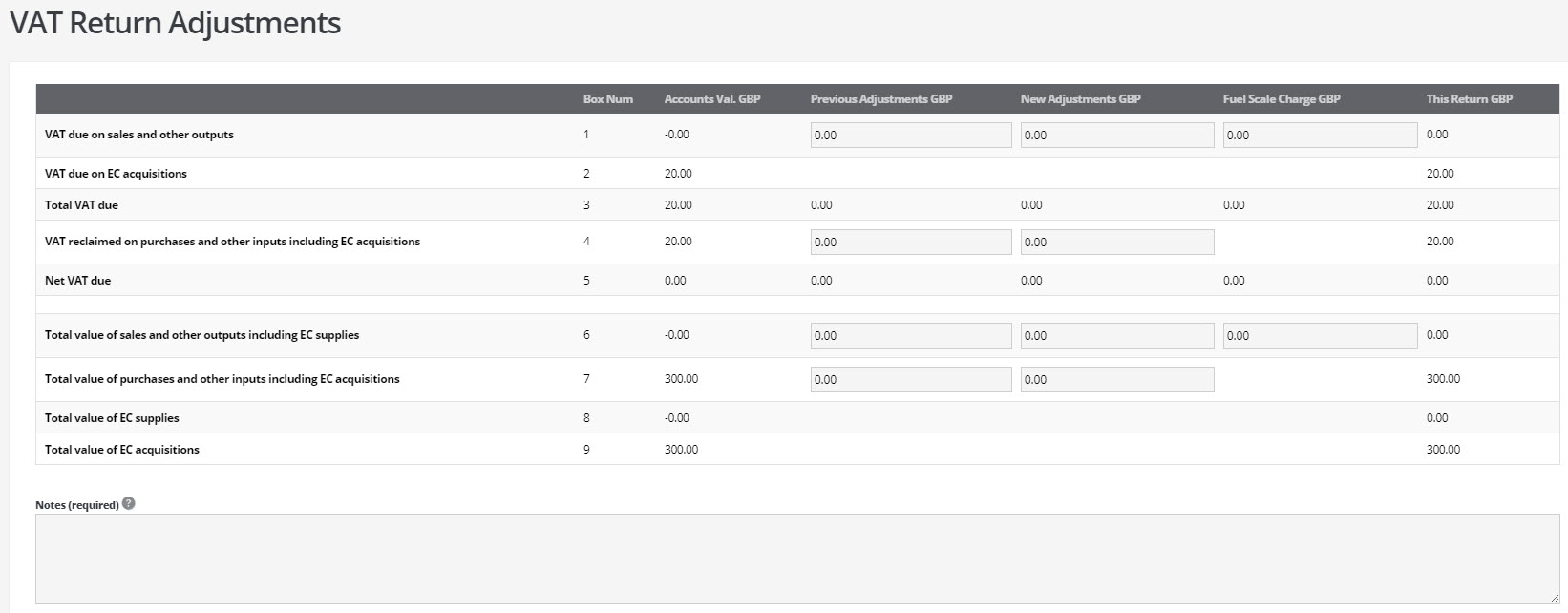

The VAT return is updated as follows:

· Box 1 £20.00 VAT due in this period on sales and other outputs

· Box 4 £20.00 VAT due in this period on acquisitions from other EC Member States

· Box 7 £300.00 Total value of purchases

The input VAT of £20.00 attributed to the only vatable line is claimed in box 4 and negated in box 1:

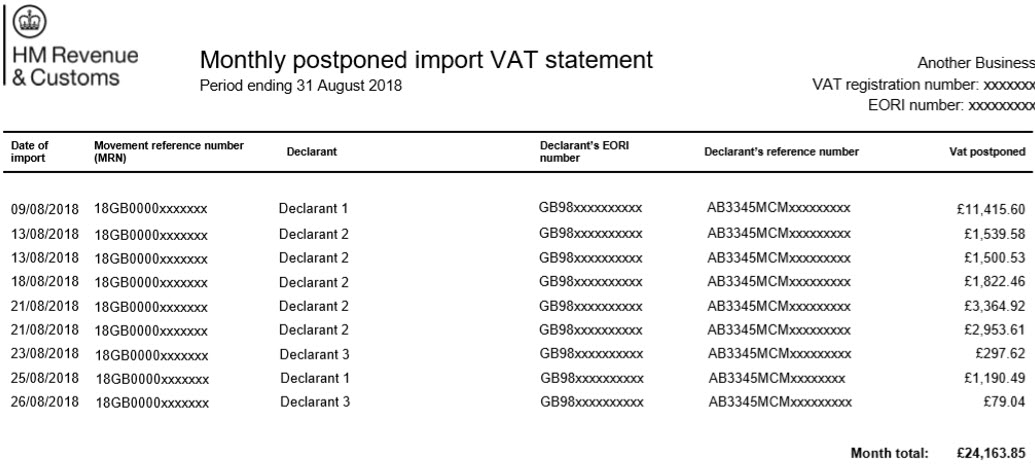

Monthly Postponed Import VAT Statement

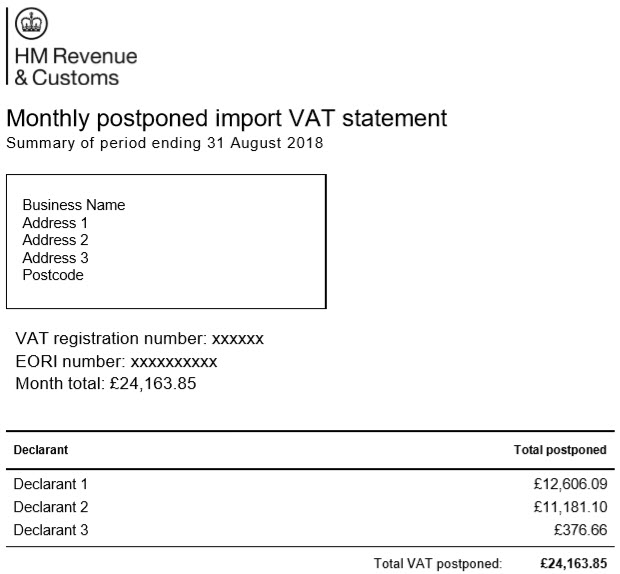

Since 1 January 2021, the HMRC provide all VAT registered businesses with a monthly statement of UK imports.

This statement should agree with the import purchase values submitted on the VAT100 Return for the reporting period.

Example of a Monthly Postponed Import VAT Statement:

Businesses are responsible for reconciling their monthly postponed import VAT statement with their VAT return report and for providing supporting evidence for the values submitted on their VAT returns.

In the event of any differences, BCE users may consider the following options:

1. Use the ‘VAT Return Adjustments’ option to adjust their VAT return values.

This can be done by completing the respective boxes within the ‘New Adjustments GBP’ column to agree to the import VAT statement in order to complete and submit the VAT return on time.

The VAT adjustments entered will be reversed on the next VAT report which shall allow users to:

- Identify and correct any missing documents within BCE in preparation for the next VAT return

- Take up any discrepancies on the import VAT statement directly with HMRC

- Carry any further differences forward to the next VAT reporting period

1. Controlled edit of csv file prior to submitting to HMRC

Prior to submitting the VAT return using the business tax portal for making tax digital, there is an opportunity for the entries to be adjusted in the csv file to agree with the monthly statement of UK imports.

This is provided that any such changes are correctly calculated and represent a controlled change to the values submitted to HMRC.

Postponed VAT Accounting – BCE VAT Schemes

BCE supports three VAT schemes:

- Standard VAT Invoice Accounting

- Cash Accounting VAT

- Flat Rate VAT

The standard VAT invoice accounting method is the only option that supports Postponed VAT Accounting.

Standard VAT Invoice Accounting

This is the most common method of VAT reporting covering a calendar period year to record input and output VAT for purchases and sales documents.

Businesses registered for VAT are generally required to submit their VAT reports on a monthly calendar or quarterly basis unless an alternative VAT reporting frequency is agreed with the HMRC tax office.

BCE documents are recorded within the current VAT period. If documents are backdated to previously submitted ‘closed’ VAT periods they will be forced to the current VAT reporting period.

Cash Accounting VAT

The Cash Accounting method of VAT reporting is used with agreement from HMRC.

The method supports a business’s cashflow where the input VAT reclaimed on purchases and the output VAT due on sales do not become recoverable or payable until such time the invoices are settled.

HMRC state that businesses who trade overseas do not qualify for Cash Accounting status, therefore Postponed VAT Accounting is not supported.

Cash Accounting VAT users should not use the ‘EU Import’ and ‘non EU Import’ VAT types.

Flat Rate VAT

The Flat Rate method can only be used with agreement from HMRC.

In general, this method applies to an agreed percentage VAT rate for sales only and all purchases are excluded.

HMRC state that businesses who trade overseas do not qualify for Flat Rate status, therefore Postponed VAT Accounting is not supported.

Flat Rate VAT users should not use the ‘EU Import’ and ‘non EU Import’ VAT types.