Out of Period Documents

- Introduction

- Purpose of this document

- Company Settings

- Tax and Payroll

- Financial Periods

- User permissions

- Out of Period Document – Sales Invoice

- Out of Period Document – Credit Notes

- Credit note - Open accounting date period

- Credit note - Closed accounting date period

- Reporting Out of Period Documents

- Legislative/Accountancy Reporting

- Setup Wizard

Introduction

For users of BCE systems with ‘Financial Period Management’ enabled, there may be a requirement to store out of period documents.

Under normal operating conditions it is not possible to store documents to a closed financial period in BCE. If a financial period is closed it would be necessary for the period to be reopened to store a backdated document, however, if the accounts have been finalised and audited this may not be permitted.

To provide flexibility and allow out of period documents to be managed under controlled conditions, users may be granted permission to access and enter an ‘Accounting date’. This permits BCE to retain the original ‘Document date’ for reporting purposes but to be able to account for the document within an open financial period.

Out of period documents will retain their document invoice date (tax point) and this will be respected by the system when printing invoices, aging debts and preparing statements or remittances but will be recorded using an accounting date within an open financial period.

In summary, the definition of dates is:

Created date: Today

Document date (Invoice date)

Tax point for correct reporting and aging

Due date: Calculated based on agreed terms and the document date

Accounting date: Set for out of period documents

A pdf version of the 'Out of Period Documents - User Notes' can be downloaded from here

Purpose of this document

Businesses generally operate within clearly defined financial periods representing their accounting year. A move to period driven accounts shall appeal to users wanting to migrate to BCE.

Users responsible for their accounts will normally close financial periods following an ordered period end procedure so the need for out of period documents is expected to be an exception rather than a day to day activity.

In the event of financial periods being audited, preventing periods from being reopened, use of the out of period document feature provides users with options to store documents created following period closure in a controlled way.

This document describes the settings and expected behaviour to accommodate out of period documents for both accounting and legislative reporting requirements.

Company Settings

The ‘Out of Period Documents’ feature is available when ‘Financial Period Management’ is enabled. Access to this feature requires system settings to be set as follows:

Enable Financial Period Management

Financial Periods

User Permission

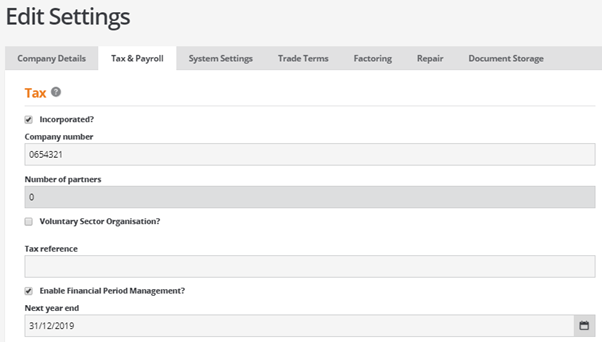

Tax and Payroll

From the Tax and Payroll tab, financial periods are enabled by ticking ‘Enable Financial Period Management?’

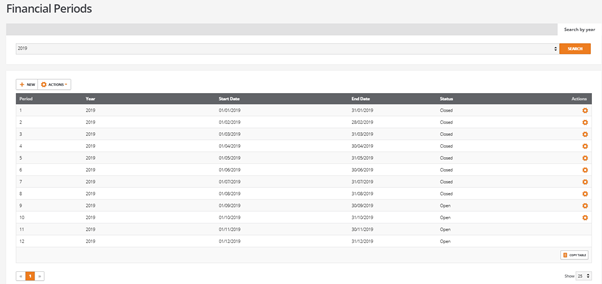

Financial Periods

With financial period management enabled the ‘Financial Periods’ option is available from the ‘Accounts’ menu where financial periods are defined for the business accounting year.

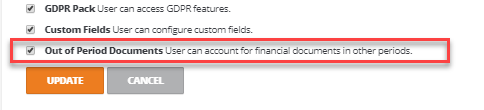

User permissions

To provide controlled access and the ability to set an accounting date for out of period documents individual users shall require the following permission to be set:

Out of Period Document – Sales Invoice

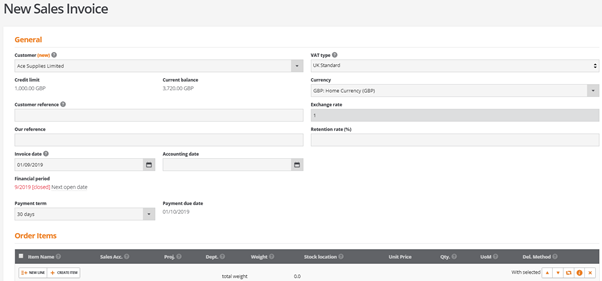

The following example illustrates how to store an ‘Out of Period’ Sales Invoice document.

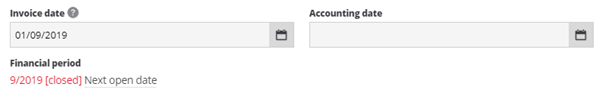

A new Sales invoice is created and dated 01/09/2019. The date entered is relative to period/year 09/2019 and this financial period is closed.

On entering the document date (Invoice date) the system detects that the date relates to a closed financial period.

The system informs the user that period 09/2019 is closed and provides an option to select ‘Next open date’.

If it is not possible to reopen the closed period, then the user may choose to set an accounting date within an open period whilst retaining the original document date for tax and aging purposes.

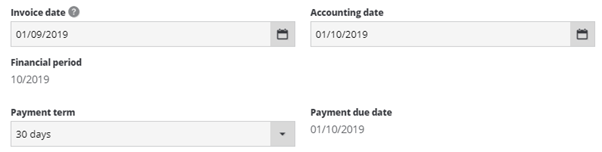

Selecting ‘Next open date’ will force the accounting date to the first day of the next available open financial period.

Users may choose to accept this date or select an accounting date of their choice provided it is within any open financial period and not later than today’s date.

Out of Period Document – Credit Notes

The following examples illustrate storing a credit note for an out of period sales invoice within:

An open accounting date period

A closed accounting date period

Credit note - Open accounting date period

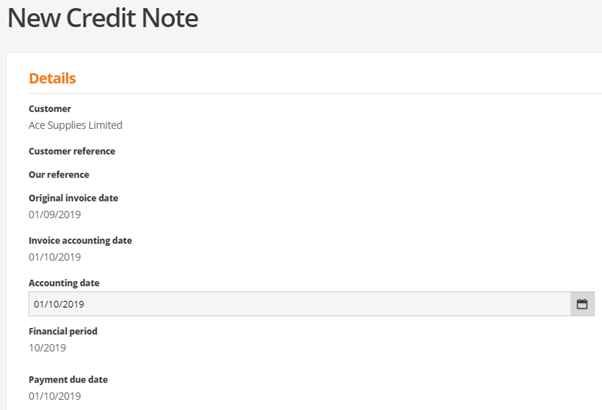

As credit notes are created from existing invoices they will inherit their dates and properties from the original invoice.

If the original invoice was stored as an out of period document, the credit note will respect the original document invoice date and accounting date.

Credit note - Closed accounting date period

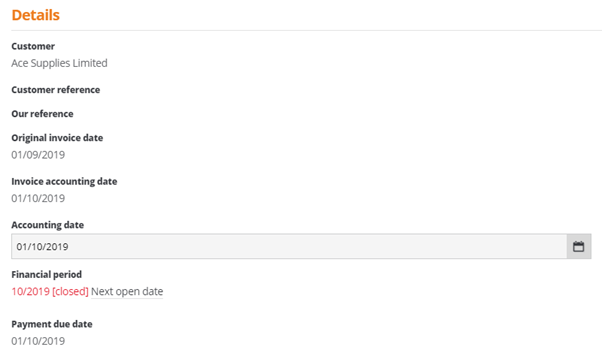

If the original invoice was stored as an out of period document, the credit note will respect the original document invoice and accounting date.

However, if the accounting date used for the original invoice is now out of period itself, the system informs the user that the period is closed and provides an option to select ‘Next open date’.

Selecting ‘Next open date’ will force the accounting date to the first day of the next available open financial period.

Users may choose to accept this date or select an accounting date of their choice provided it is within any open financial period and not later than today’s date.

Reporting Out of Period Documents

Where out of period documents are stored, it is essential that the correct dates are used for accounting and reporting purposes.

For example, the document date must be respected for legislative reporting and the correct aging of documents. As the documents are out of period in respect of the stored document within BCE, the internal accounting reports will be based on the accounting date used.

Where relevant the BCE enquiry screens inform the user of the document and accounting dates.

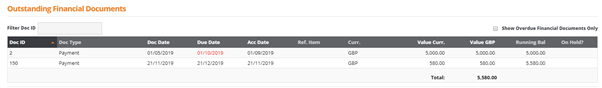

The customer and supplier show pages display the Document date, the calculated Due date together with the Accounting date. Where the Accounting date is later than the Document date, this indicates that the document was stored as an out of period document.

The following lists whether the Document or Accounting date is used in the context of their reporting requirements:

Legislative/Accountancy Reporting

VAT Return

Documents included on the VAT return will use the document date as this represents the correct tax point.

There is no dependency on financial periods when compiling the VAT report and the VAT report may be run after the financial period closure.

The VAT report start date and end date can be relative to closed financial periods.

Recurring Items

Where reoccurring items are created and backdated to a closed financial period. The backlog of any recurring items for out of period dates will be forced to run within the first open financial period and the remaining recurring items will be created when due.

Finance Agreements

Where finance agreements are created and backdated to a closed financial period, the agreement date is stored.

Depending on the repayment terms any repayment transactions that occur for out of period dates will be forced to have an accounting date of the first day or the first available open period. The backlog of any out of period documents will be forced to run within the first open financial period and the remaining payments will occur when due.

From the transaction ID, drilling into the ‘Payment Out’ id will display the original payment date.

Setup Wizard

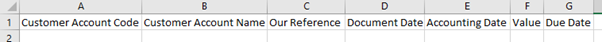

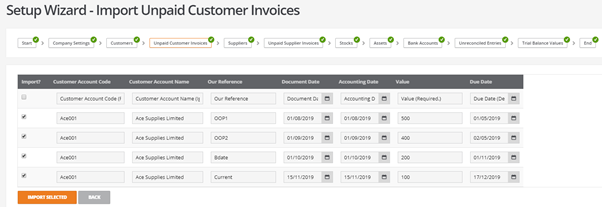

For users migrating to BCE, the setup wizard allows records and documents to be imported from data files in csv file format.

The following import options require a document date to be set:

Unpaid Customer Invoices

Unpaid Supplier Invoices

Each of the templates allow a document date to be entered. If the document date is known to be relative to a closed BCE financial period, the user has the option to specify an accounting date for an open financial period.

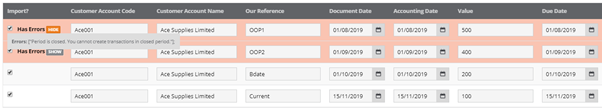

During the import process the csv file validates the data before it is imported and committed to BCE

The validation will alert the user to any closed financial periods and this provides the user with the opportunity to set an accounting date relative to an open period.

Once the accounting dates are corrected the system can proceed and import the selected items.