VAT - Reconciling the VAT Report with the VAT Return

VAT Reporting

VAT - Reconciling the VAT Report with the VAT Return

This document explains how the BCE VAT Return Report is reconciled to validate the values reported to HMRC when submitting a VAT return.

When running the BCE VAT Return Report for the selected VAT reporting period, a list of all transaction lines for sales and purchases is displayed.

The sum of the sales and purchase net values and their VAT values should correspond with the values reported within the respective boxes on the VAT Return.

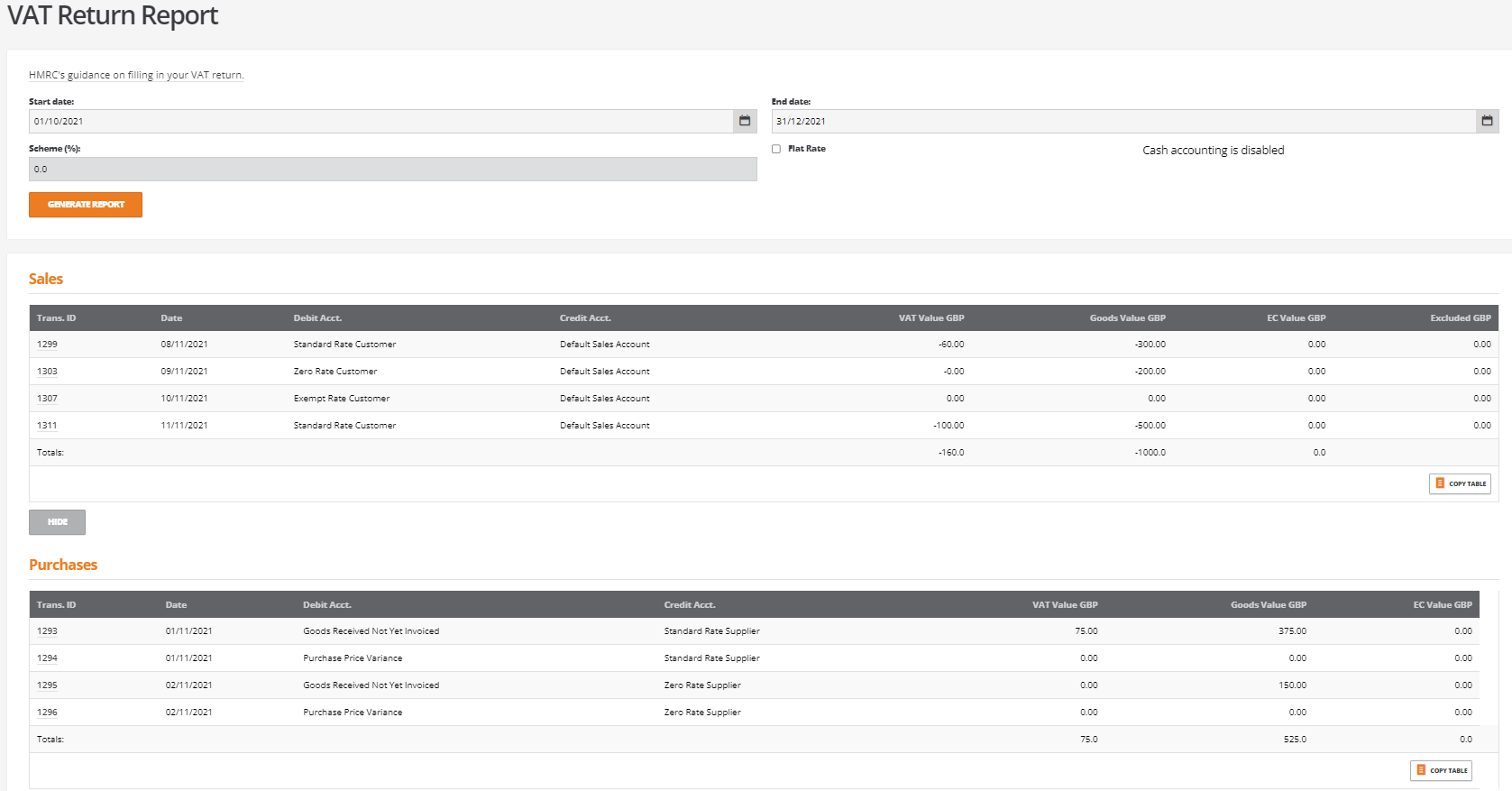

Running a VAT Return Report generates the following report:

The VAT Report provides list of all sales and purchase document lines that fall within the VAT reporting period.

This will include any backdated or out of period documents that have not been previously reported on an earlier VAT Return.

The information is presented in the following columns:

Trans ID

Transaction line number

Date

Document date

Debit Acct.

Transaction line debit account

Credit Acct.

Transaction line credit account for the supplier

VAT Value GBP

The calculated VAT value of the transaction line

Goods Value GBP

The net value of the transaction line

EC Value GBP

For UK Import transactions the value of the transaction line is shown in the BCE base currency

To reconcile the VAT Report to the VAT Return:

The sum of the net sales 'Goods Value GBP' is reported in box 6

The sum of VAT on sales, 'VAT Value GBP' is reported in box 1

The sum of the net purchases, 'Goods Value GBP' is reported in box 7

The sum of VAT on purchases, 'VAT Value GBP' is reported in box 4

Notes:

Exempt sales and exempt purchase items are treated as out of scope and are not reported on the VAT Return

UK Imports of Goods and Services

Where UK imports are recorded, the HMRC require additional VAT information to be reported on the VAT Return in respect of:

- Import of goods - Postponed VAT Accounting

- Import of services - Reverse charge VAT

The reporting of these values will cause the VAT Report to be different to the VAT Return for the following reasons:

Postponed VAT Accounting - UK Import of Goods

From 1 January 2020, for the import of goods into the UK, the HMRC state that we must record the net value of purchases in box 7 and record a notional VAT value had the transaction occurred within UK shores in box 4 as input tax.

In accordance with Postponed VAT Accounting rules, the VAT value reported in box 4 is negated in box 1 so that there is no VAT claim or liability.

Reference to the HMRC statement can be found at the following address:

https://www.gov.uk/guidance/complete-your-vat-return-to-account-for-import-vat

In summary this states the following:

How to complete your VAT Return

You must account for postponed import VAT on your return, for the accounting period which covers the date you imported the goods

The normal rules apply for what VAT can be reclaimed as input tax and your monthly statement will contain the information to support your claim

Box 1 Include the VAT due in this period on imports accounted for through postponed VAT accounting. You’ll be able to get this information from your online monthly statement, or you must estimate the amount if you’ve delayed your customs declaration and do not have a statement

Box 4 Include the VAT reclaimed in this period on imports accounted for through postponed VAT accounting. You must estimate the amount if you have delayed your customs declaration and do not have a statement

Box 7 Include the total value of all imports of goods in this period, not including any VAT

Postponed VAT Accounting - Calculation example

For Postponed VAT Accounting, importing goods into the UK, this will result in the VAT Return box values not equaling the sum of the purchase transaction VAT value on the VAT Report.

This is because this is a VAT return reporting requirement only and there are no actual VAT values calculated on the UK import transaction lines.

For example:

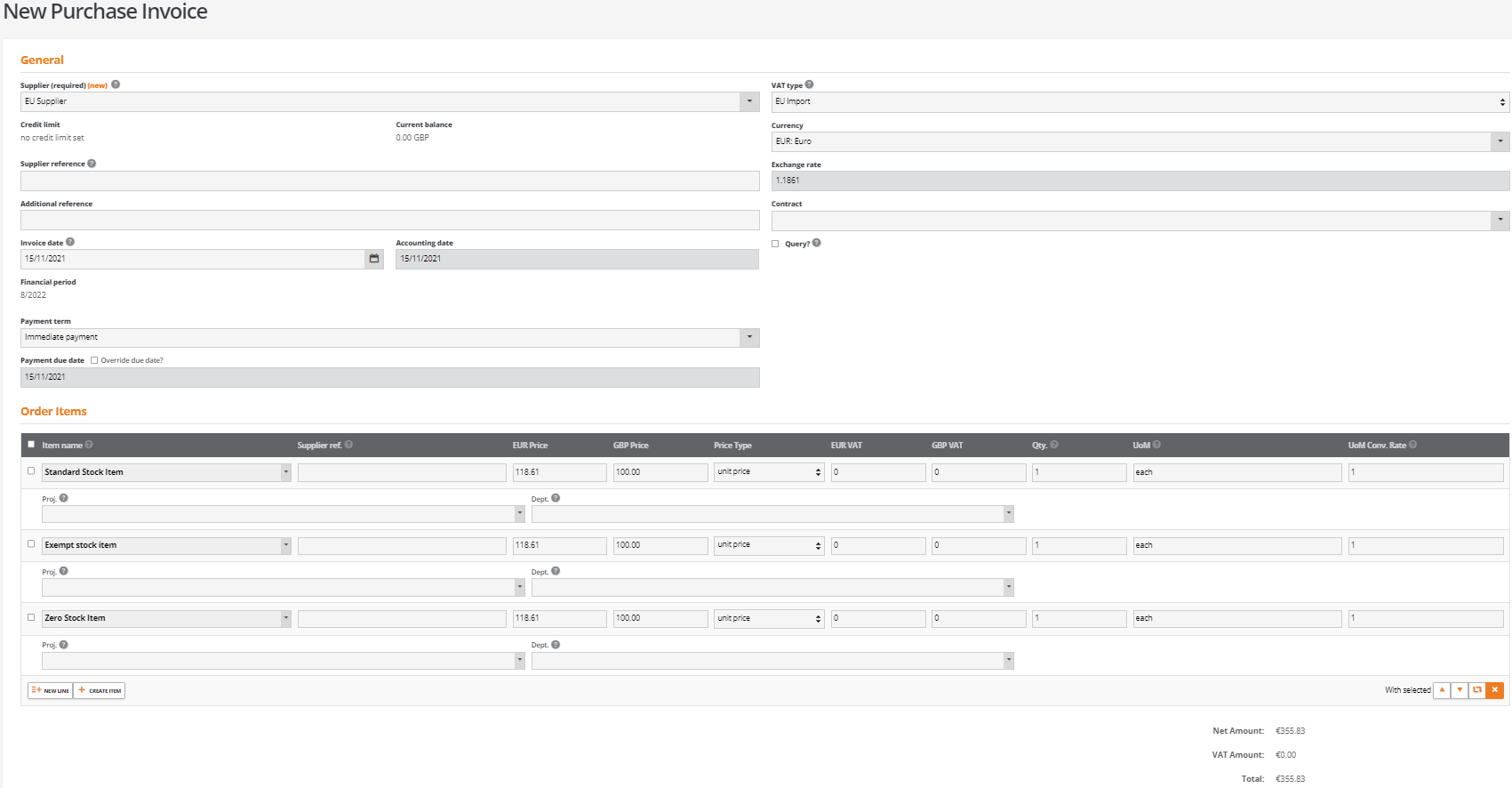

The following purchase invoice is created for an EU supplier with three transaction lines with a base value of £100 each:

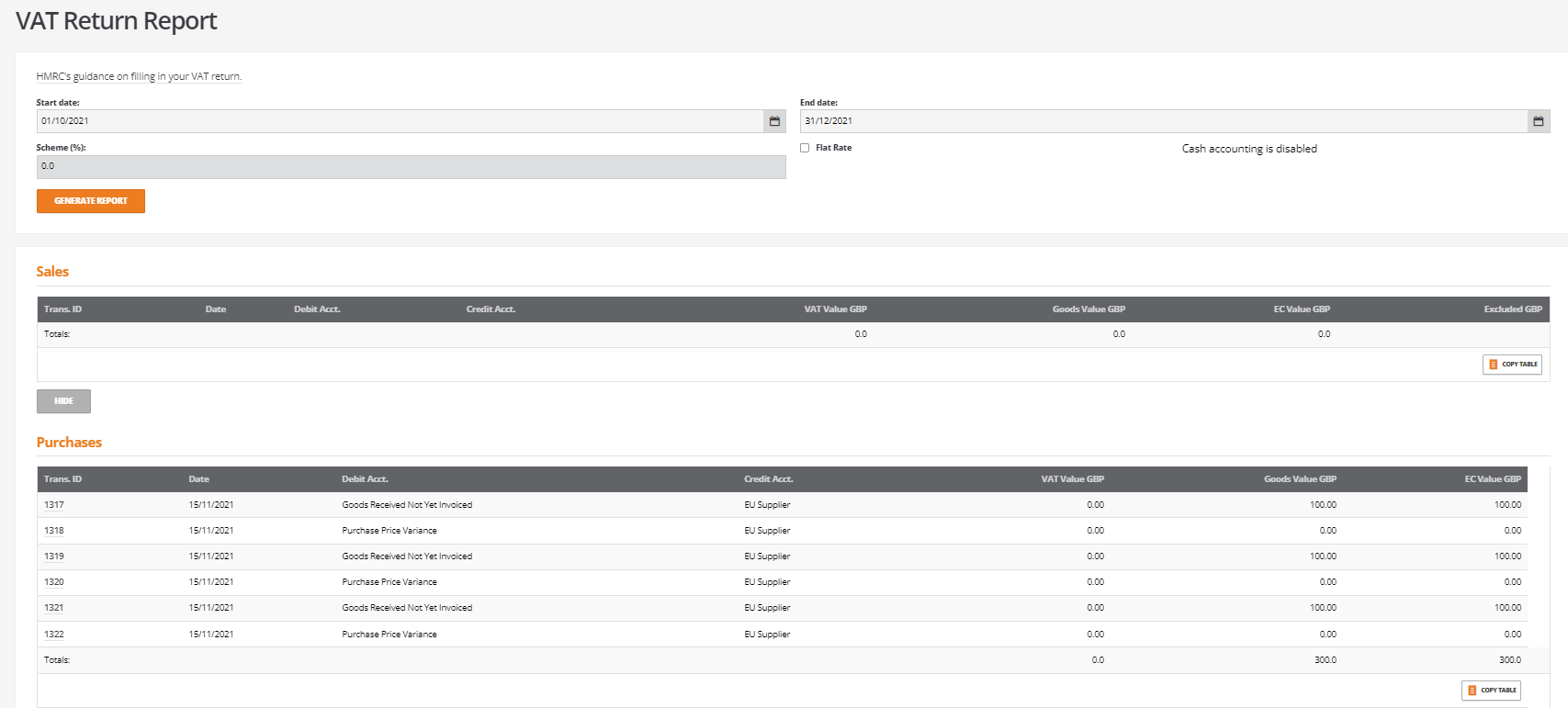

When the VAT Return Report is run, the VAT Report and VAT Return boxes are updated as follows:

The net goods value of all purchases is recorded correctly in box 7 of the VAT Return.

As none of the purchase transaction lines are subject to VAT, the total of the VAT in the VAT Report remains as zero.

For Postponed VAT Accounting, all goods lines that are normally subject to VAT in the UK must have a notional VAT value reported on the VAT return at the equivalent rate.

Purchase Line | Line Item type | Transaction Line | Goods | Notional VAT |

1 | Goods | Line 1 is subject to standard rate VAT | 100.00 | 20.00 |

2 | Goods | Lines 2 is exempt rate VAT | 100.00 | 0.00 |

3 | Goods | Line 3 is zero rate VAT | 100.00 | 0.00 |

300.00 | 20.00 |

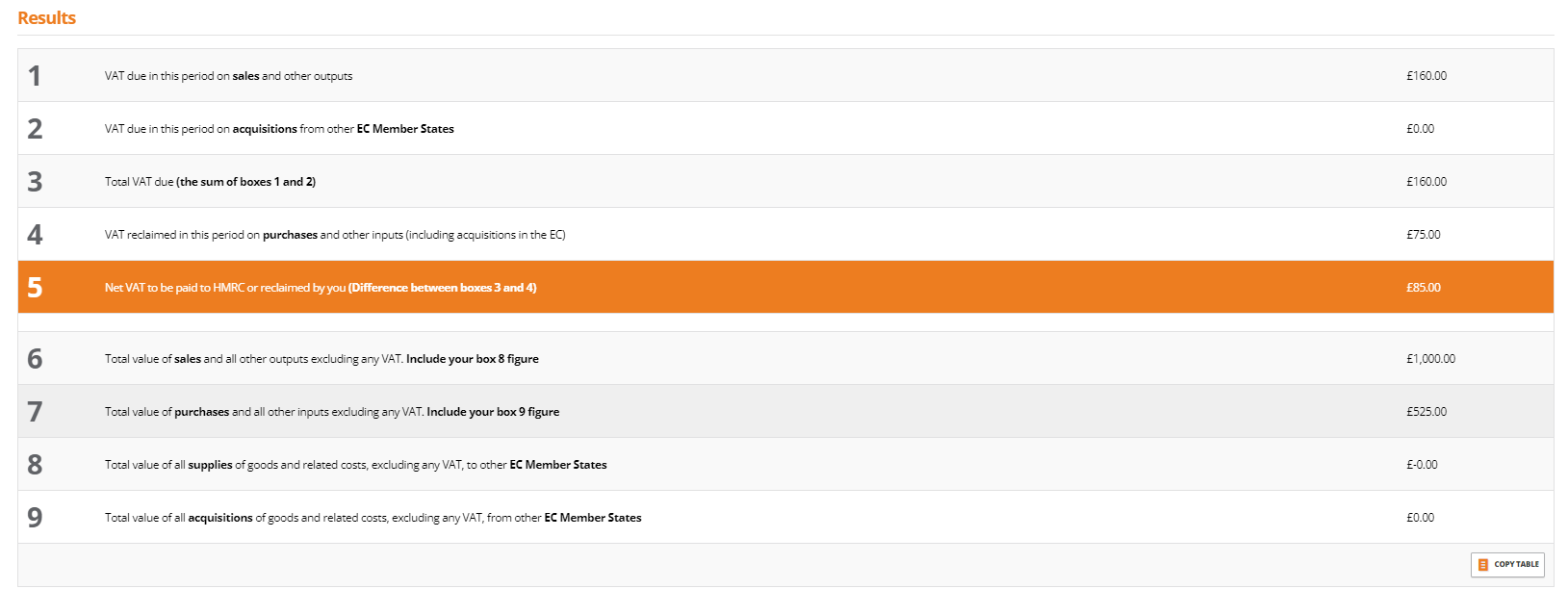

The VAT Return shows the following values:

Box 1 VAT due in this period on Sales

Reports a VAT value of £20.00 representing the notional VAT for Postponed VAT Accounting. This negates the VAT value reported in box 4

Box 4 VAT reclaimed in this period on Purchases

Reports a VAT value of £20.00 representing the notional VAT for Postponed VAT Accounting

Box 5 Net VAT to be paid to HMRC

As box 1 and box 4 negate one another there is no VAT liability

Box 7 Total value of purchases excluding VAT

Records the net value of all domestic and imported purchases

For UK businesses resident in Northern Ireland

UK businesses resident in Northern Ireland are required to separate their EU imports from non EU imports.

This is known as the Northern Ireland Protocol where the VAT Return reporting requirements are:

For purchases of imported goods from 1 January 2021, purchase invoices and purchase credit notes using VAT type ‘EU Import’ continue to update the following VAT Return boxes:

- Box 9: Imported acquisition value

- Box 7: Imported acquisition values included with all domestic purchases

- Box 4: Reclaimed VAT value (Relative to stock item VAT rate)

- Box 2: Postponed VAT due

Reverse Charge VAT - UK Import of Services

For the import of services, HMRC state that a reverse charge policy applies, therefore:

The purchase value of the services is recorded in box 7 and negated in box 6

The VAT value is reported in box 1 and negated in box 4 of the VAT report

Reference to the HMRC statement can be found at the following address:

https://www.gov.uk/guidance/vat-imports-acquisitions-and-purchases-from-abroad

In summary this states the following:

Dealing with the reverse charge

You calculate the amount of VAT (output tax) on the full value of the services supplied to you, and then enter on your VAT Return the

• amount of VAT you calculated in box 1, and if you’re entitled to reclaim some or all of the VAT on your purchase of these supplies, also put the same figure in box 4 (this in effect cancels out the figure in box 1

• full value of the supply in both box 6 and box 7.

Reverse Charge VAT on Services - Calculation example

For reverse charge VAT concerning the import of services into the UK, this will result in the VAT Return box values not equaling the sum of the sales transaction goods and the purchase and sales VAT values on the VAT Report.

For example:

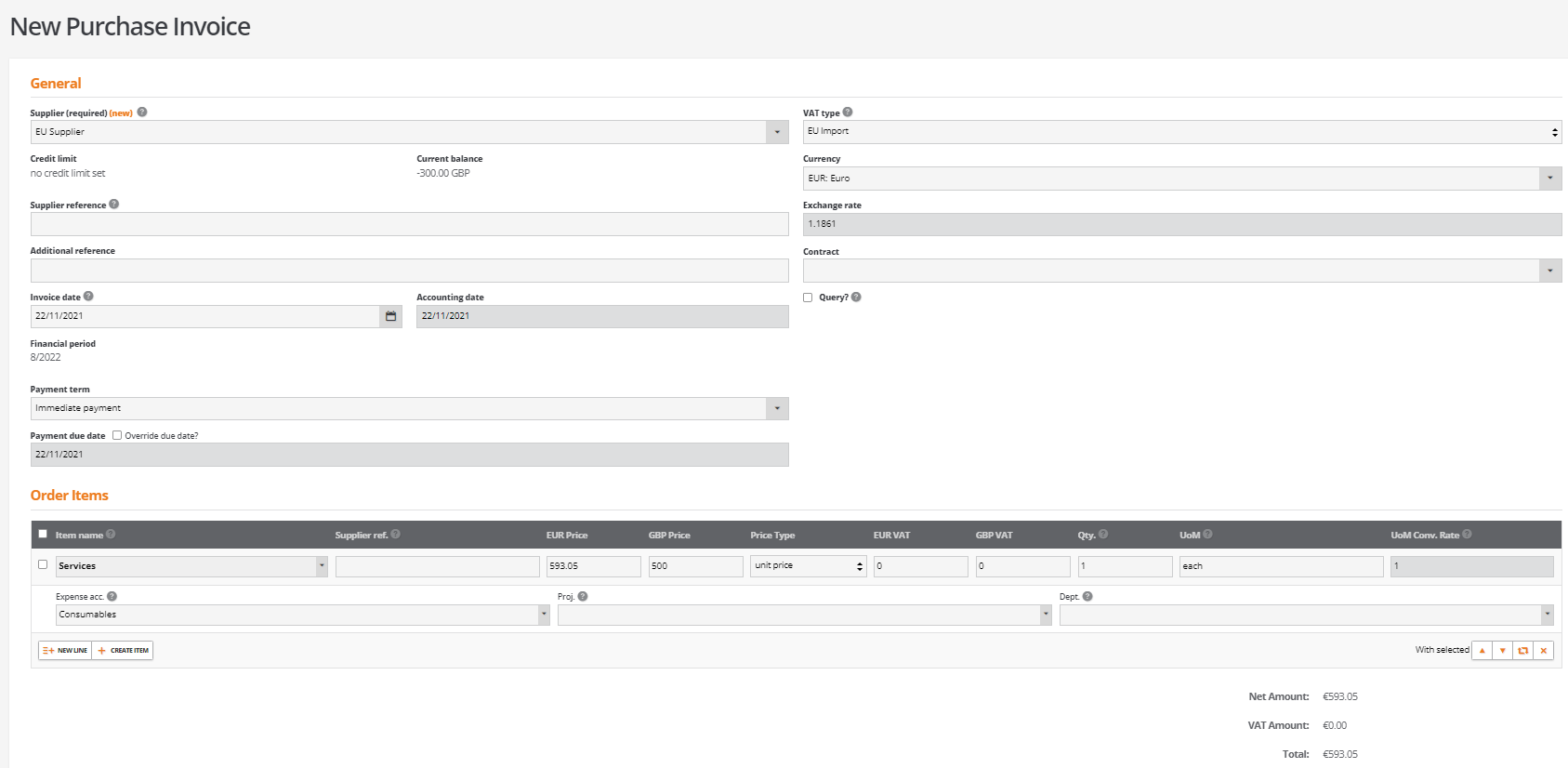

A purchase invoice is created for an EU supplier with one service transaction line for £500.00:

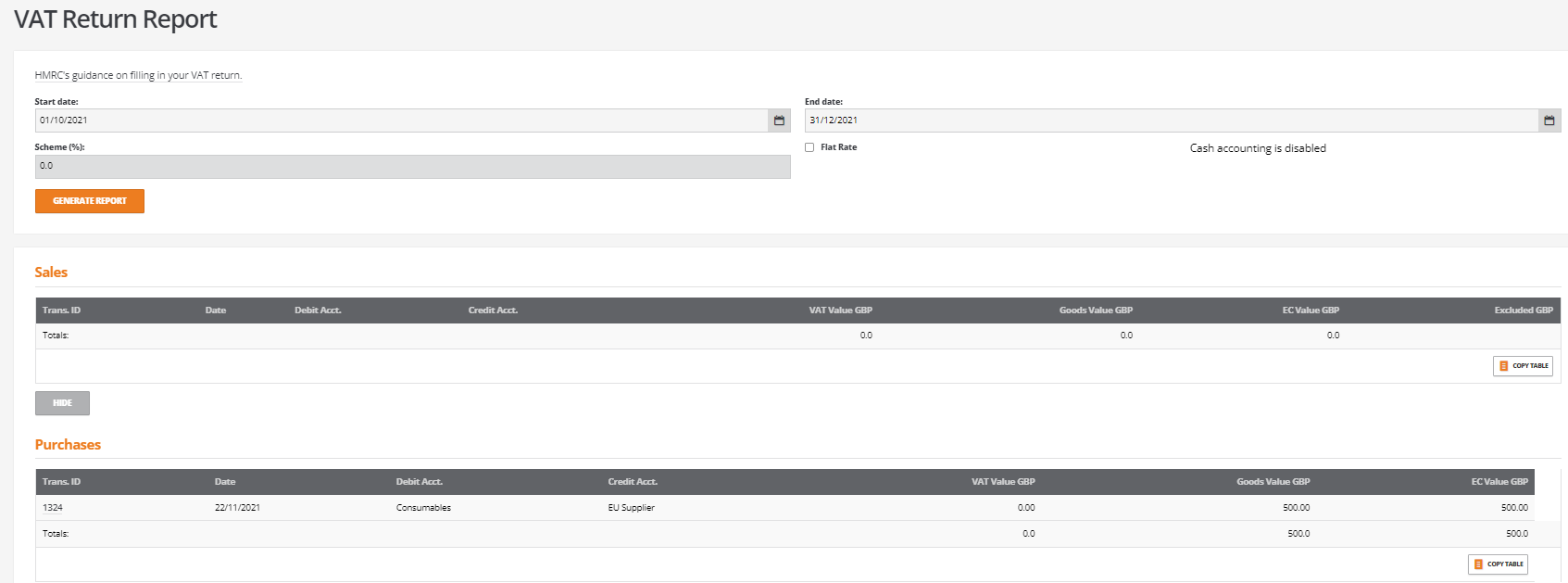

When the VAT Return Report is run, the VAT Report and VAT Return boxes are updated as follows:

The net goods value of the service purchase is recorded in box 7 of the VAT report

The reverse charge VAT is recorded as output tax in box 1

To support the reverse charge policy the net goods value of the purchase is recorded in box 6 of the VAT report

The reverse charge output VAT reported in box 1 is negated in box 4

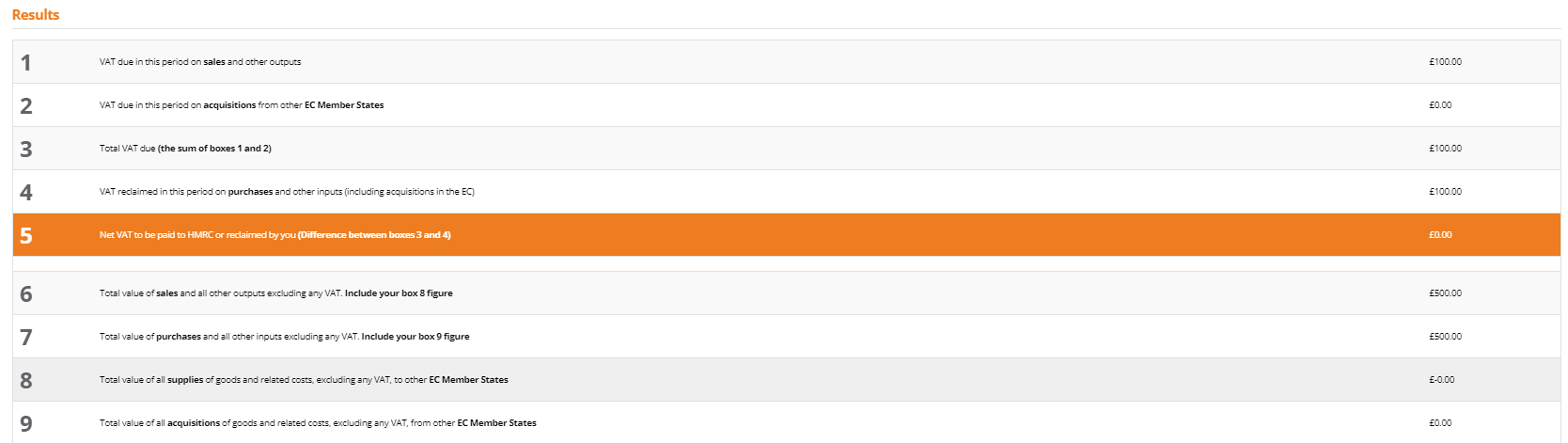

The VAT return accounts for the following values:

Box 1 VAT due in this period on Sales

Reports a VAT value of 100.00 representing the reverse charge VAT for output tax

Box 4 VAT reclaimed in this period on Purchases

Reports a VAT value of 100.00 to negate the reverse charge output VAT in box 1

Box 5 Net VAT to be paid to HMRC

As box 1 and box 4 negate one another there is no VAT liability

Box 6 Total value of sales excluding VAT

To support the reverse charge VAT reporting requirement the purchase value of services imported into the UK is reported in box 6

Box 7 Total value of purchases excluding VAT

For the purchase of services imported into the UK full value of the supply is reported box 7

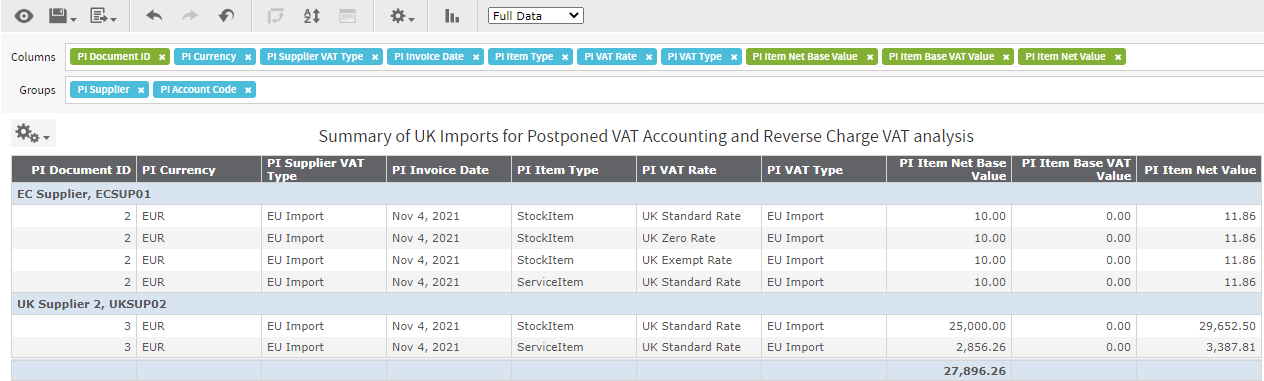

Reconciling the VAT Report using Custom Reports

To assist with the reconciliation of the VAT report where documents for imported goods and/or the import of services exist, a custom report can be created to identify the transaction line values that are subject to the notional VAT calculation.

Separate reports shall be requires for purchase invoices and purchase credit notes where it is possible to filter by non GBP currencies and sort by the document VAT type for EU or UK Imports for the VAT reporting period

The report can be exported to Excel or filtered to help identify the sum of UK imports stock items or stock service type and identify those that are subjected to a standard or reduced VAT rate.

Applying the relevant VAT rate to the sum of imported stock or service type items shall equal the differences between the BCE VAT Report and the the VAT values recorded on the VAT Return.