VAT - Cash Accounting VAT

Introduction

This guide explains how BCE manages Cash Accounting VAT.

BCE supports Cash Accounting VAT where both purchase and sales documents will only be included on the VAT return once they are fully settled.

When matching documents in BCE the system will not permit the date of the allocation to be backdated.

For systems using Cash Accounting, where invoices can only be settled in full, the process of matching payments and receipts to credits and invoices within matching sets, will set the allocation date to be the same as the last payment or receipt from the matching set.

This ensures that the tax point for the VAT return will respect the most recent settlement date and the invoices are reported in the correct open VAT reporting period.

Cash Accounting VAT

Purchase and sales transactions are included on the VAT return when they are settled in full and where the final settlement date is recognised as the tax point.

For example:

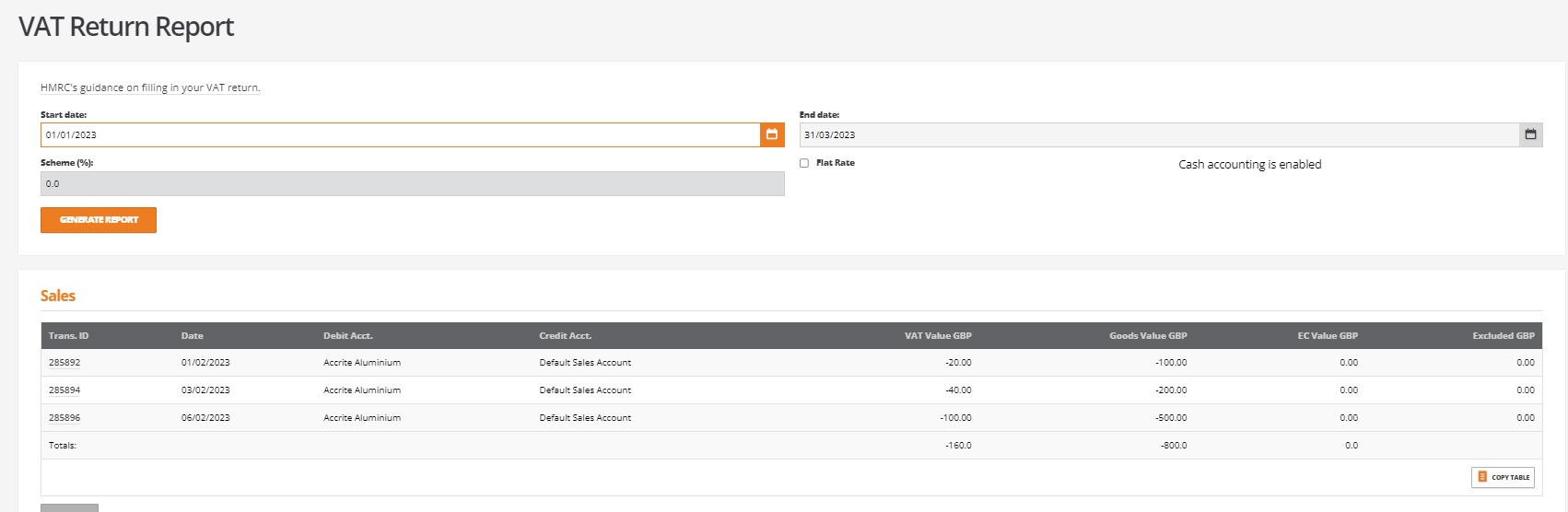

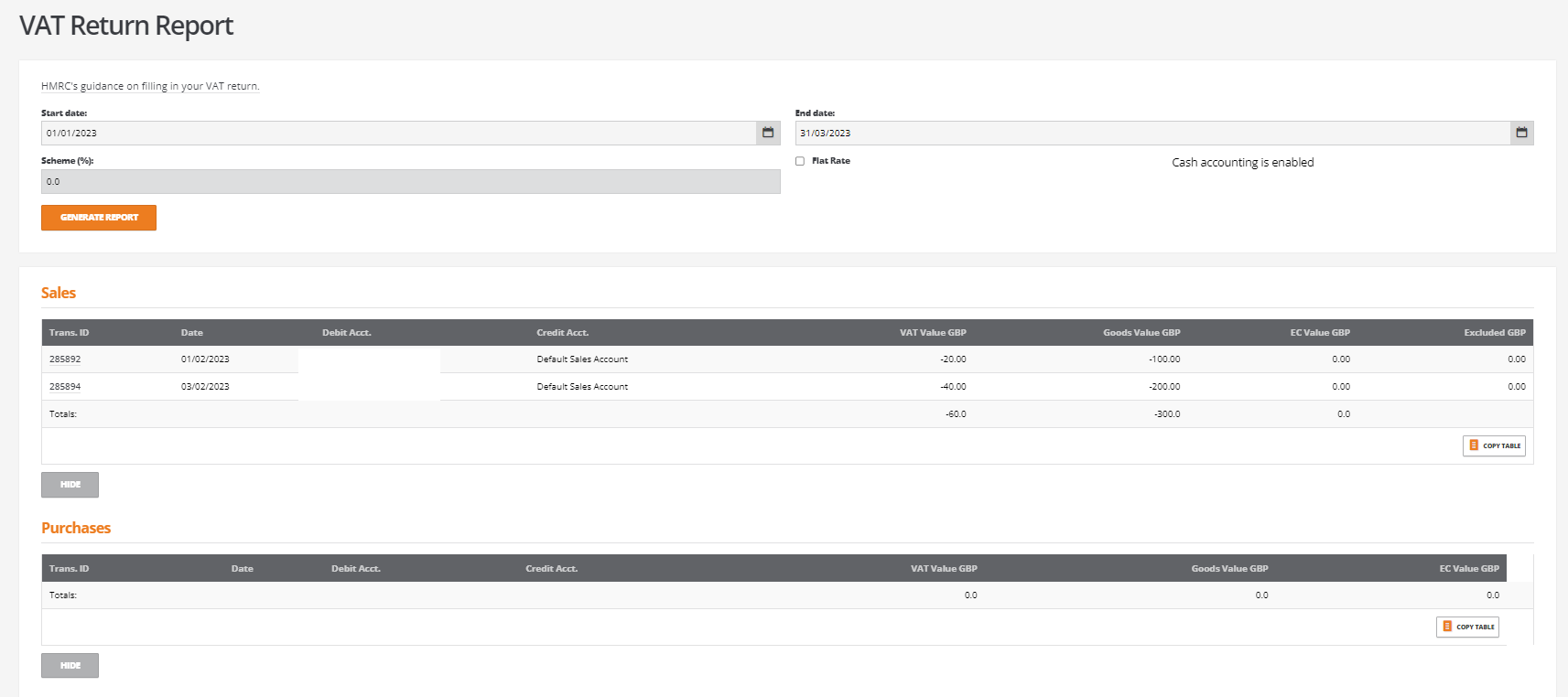

For the VAT reporting period from 01/01/2023 to 31/03/2023

A sales invoice for £100.00 plus £20.00 VAT is created with a document date of 01/02/2023.

Running the VAT report for the VAT quarter ending 31/03/2023 will not include the sales invoice as it has not been fully settled.

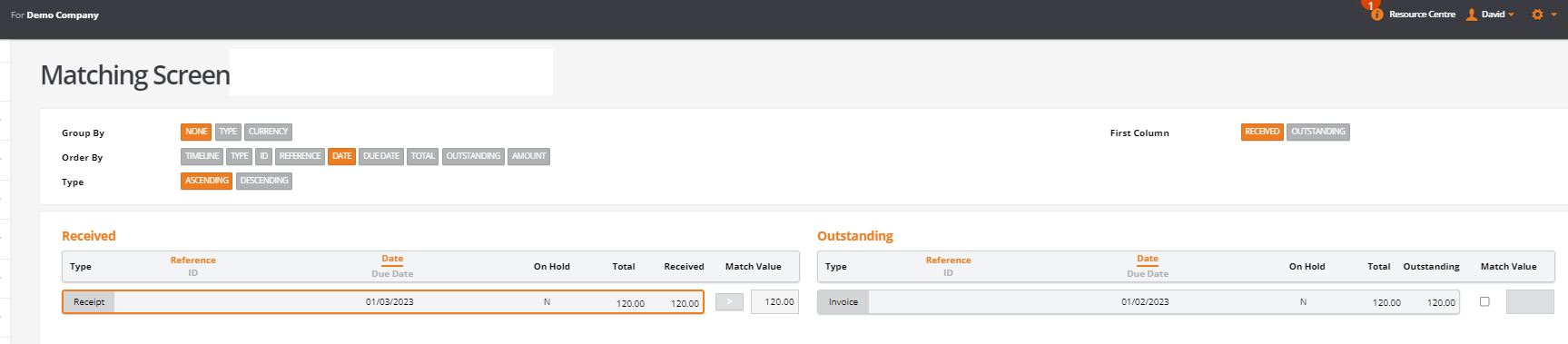

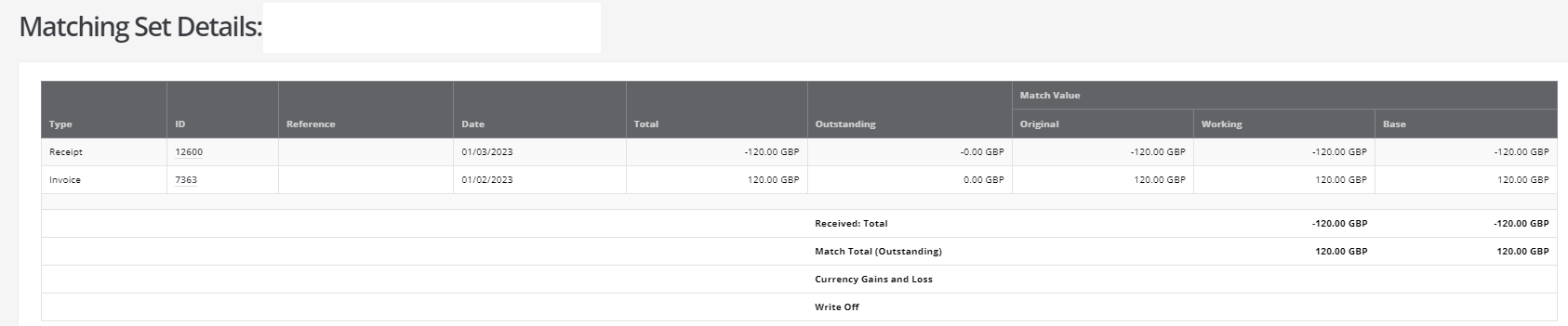

A sales receipt for £120.00 is added on 01/03/2023 in full settlement of the sales invoice.

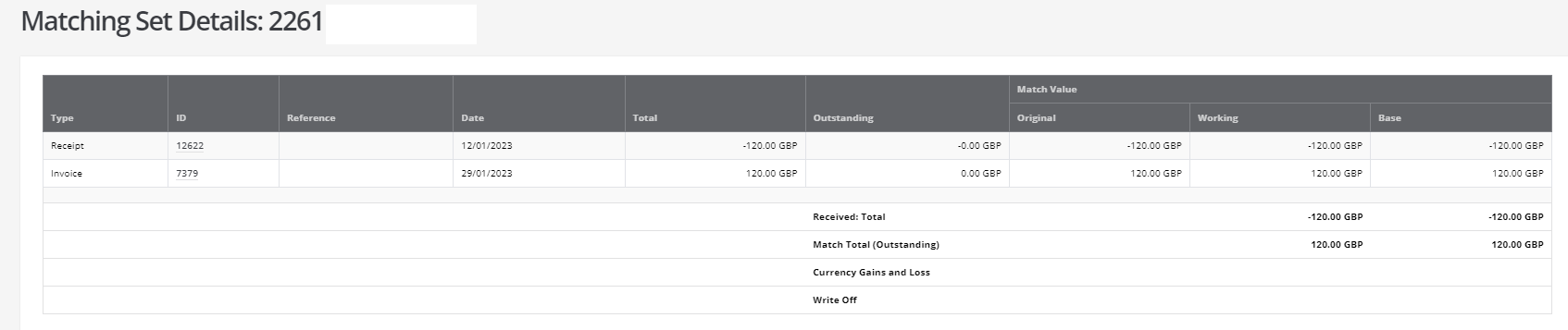

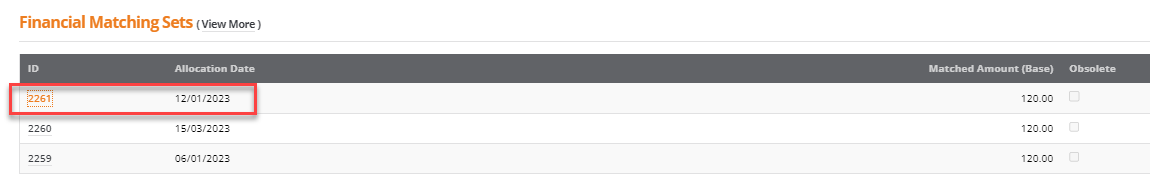

When the sales receipt is matched with the invoice, the allocation date is set to be the same as the sales receipt date:

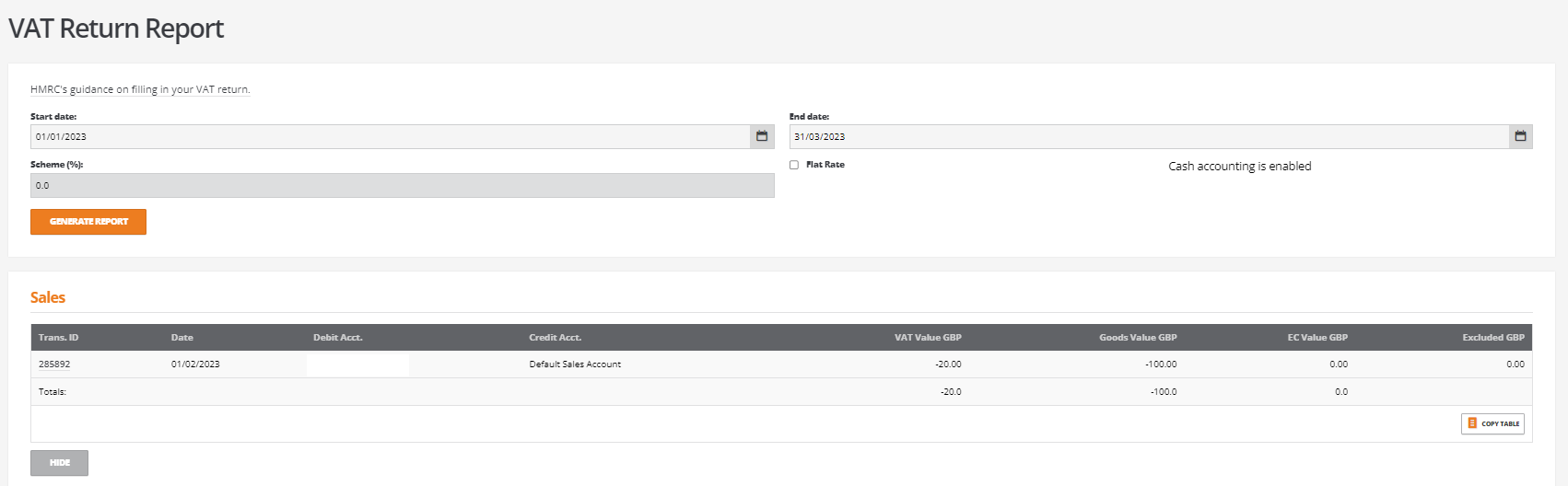

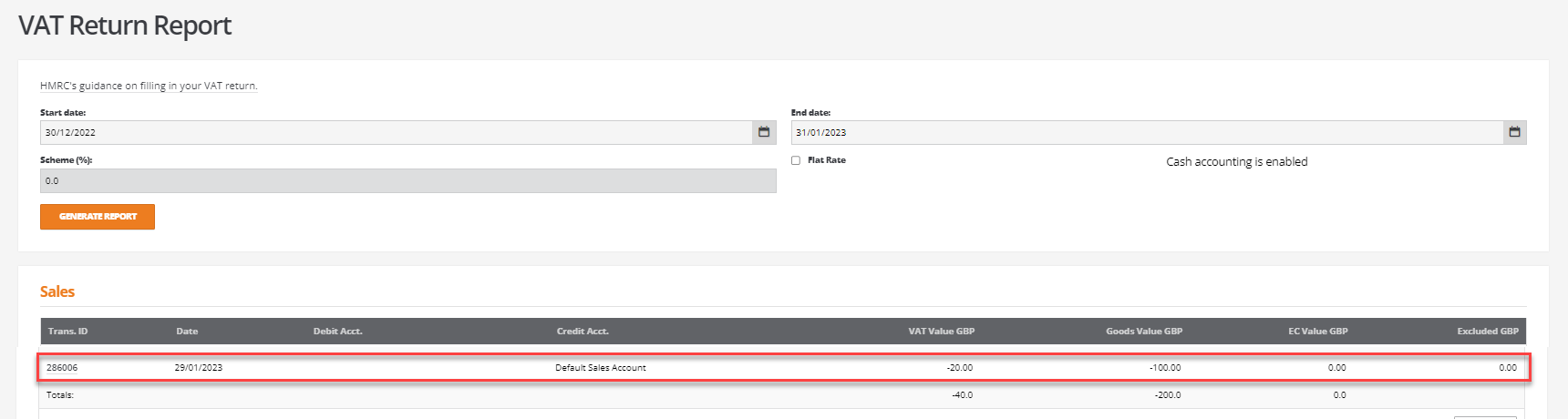

The sales invoice is now reported on the VAT report as at the original sales invoice date of 01/02/2023:

Sales Receipt Date -v- Allocation Date

Where the matching of a sales invoice occurs later than the sales receipt date.

A customer may make their payment directly to your bank and the sales receipt created at a later date but backdated to the date of the receipt. The matching of the document may occur several days later.

For example:

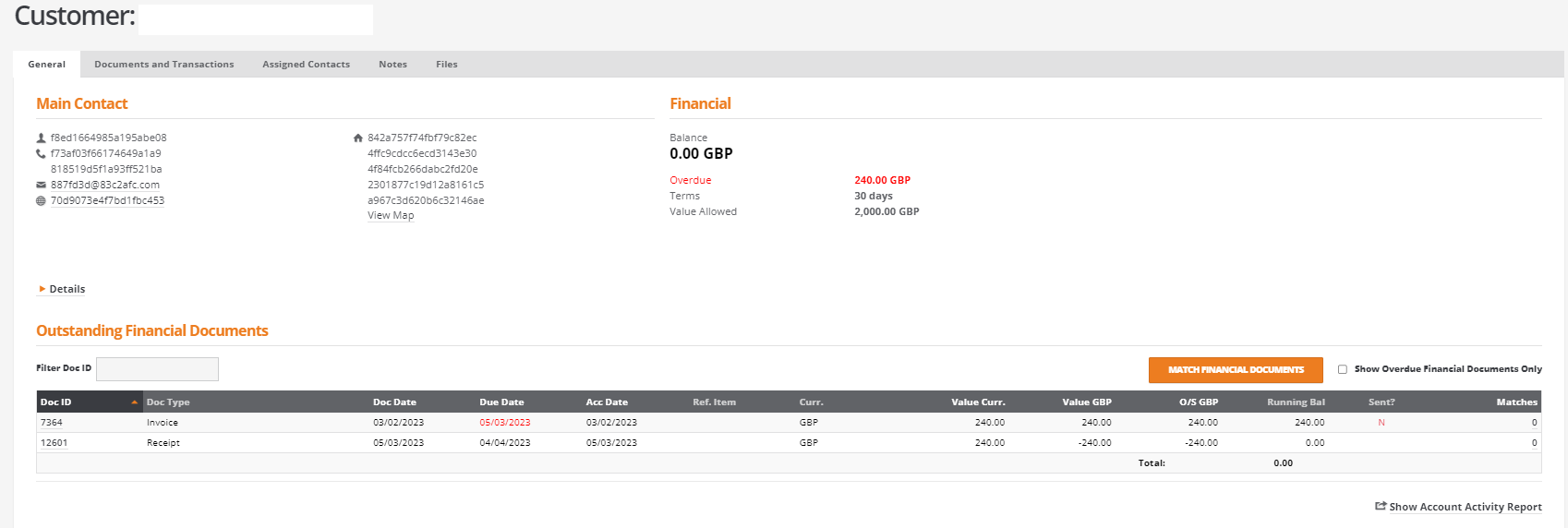

A sales invoice for £200.00 plus £40.00 VAT is created with a document date of 03/02/2023

Running the VAT report for the VAT quarter ending 31/03/2023 will not include the sales invoice as it has not been fully settled

A sales receipt for £240.00 is created on 05/03/2023 in full settlement of the original sales invoice.

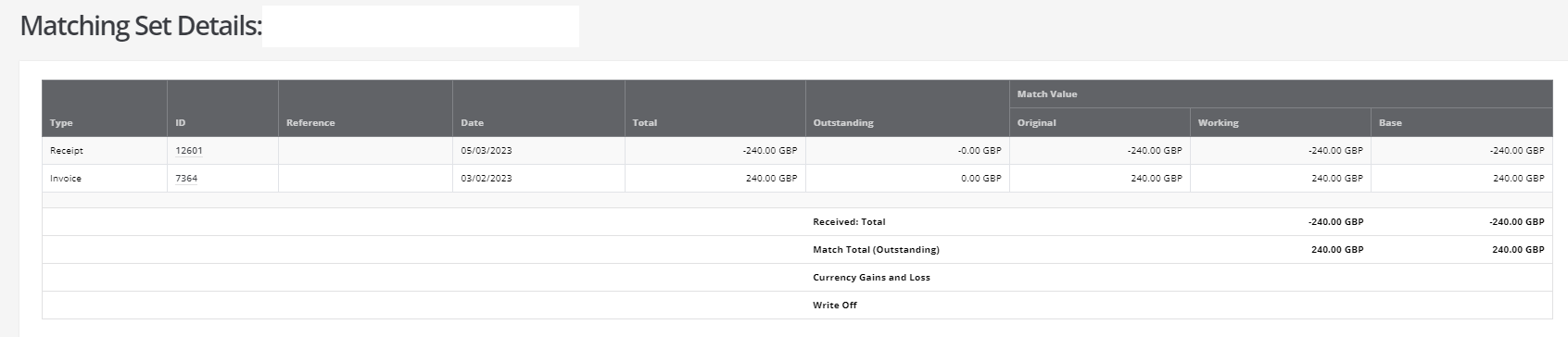

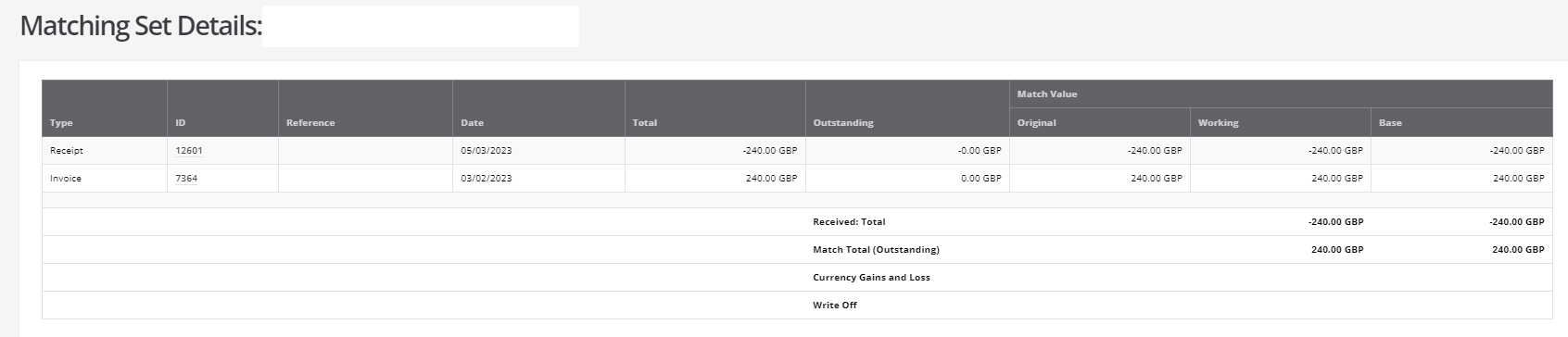

The sales receipt dated 05/03/2023 is subsequently fully matched to the Sales invoice dated 03/02/2023 on 08/03/2023.

The allocation date is set to be the same as the sales receipt date so that it respects the correct sales invoice tax point for cash accounting VAT:

The fully allocated sales invoice will now appear on the VAT report displaying the original sales invoice date.

Sales Receipt Date earlier than Sales Invoice Date

Where a receipt is dated earlier than the invoice, the matching date will still be set using the date of the receipt:

The invoice will appear on the VAT report from the date of the invoice:

Partial allocation

Where an invoice is settled by more than one receipt, BCE does not support the partial allocation of sales invoices.

Sales invoices will remain as outstanding until such time they can be fully settled by one or more receipts.

A sales receipt can be partially matched provided it fully settles a sales invoice in full or as part of a matching set that includes other receipts.

For example:

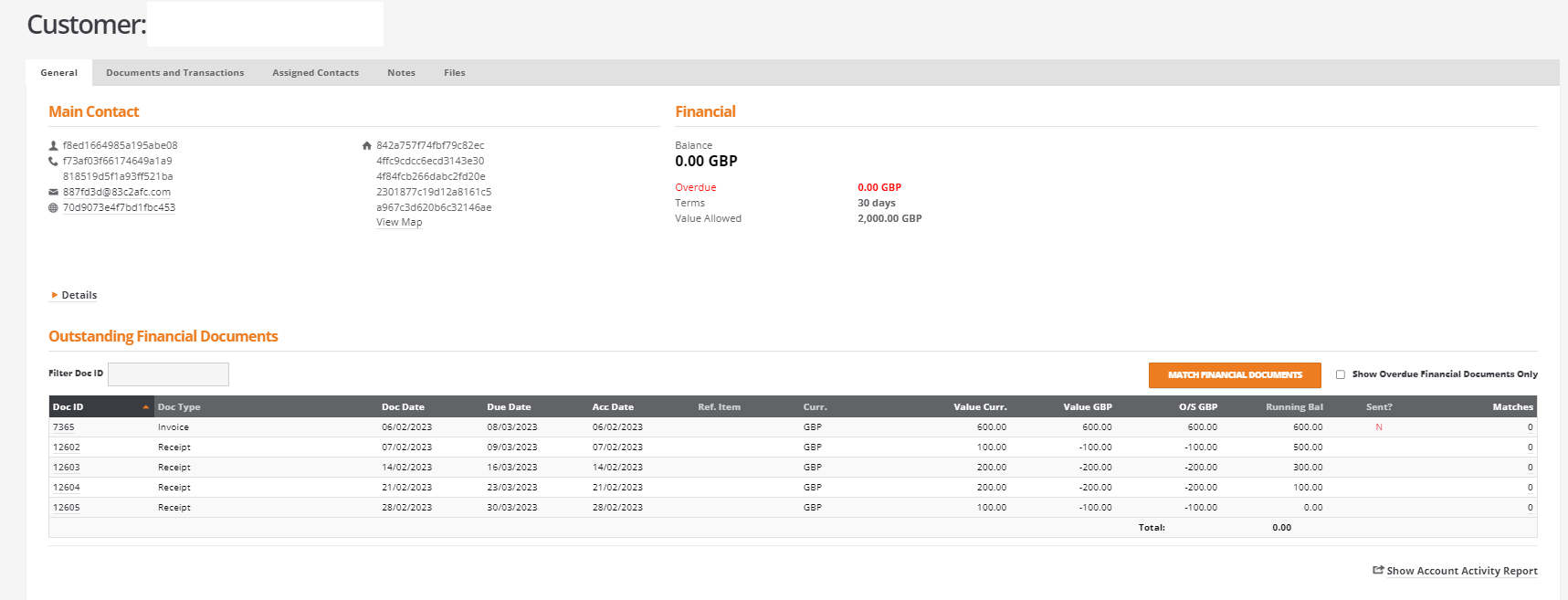

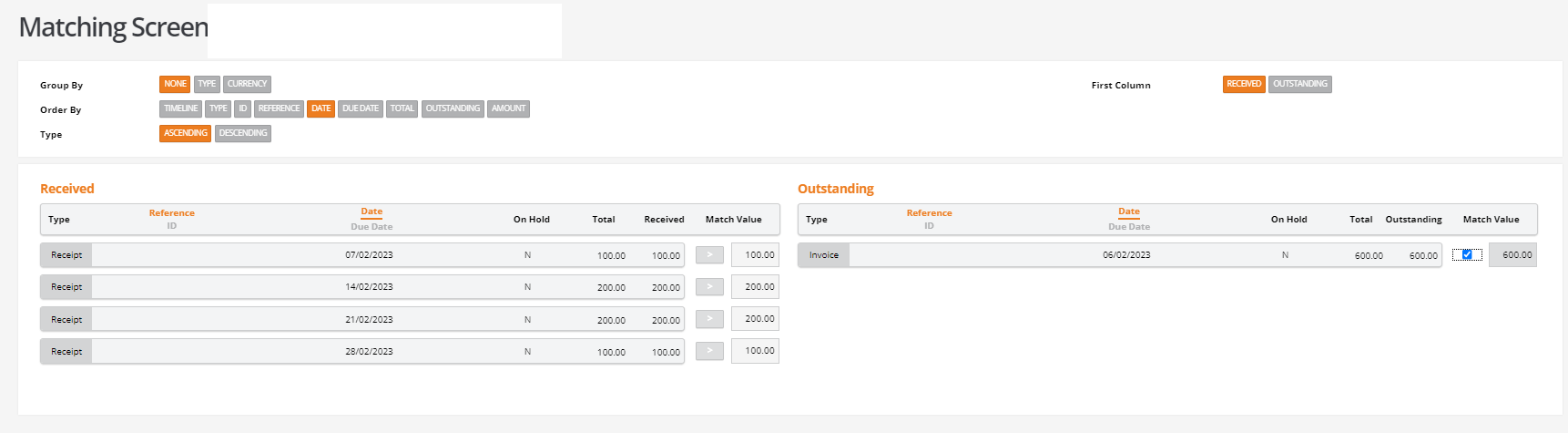

A sales invoice for £500.00 plus £100.00 VAT is created with a document date of 06/02/2023

Four sales receipts are created for:

£100.00 dated 07/02/2023

£200.00 dated 14/02/2023

£200.00 dated 21/02/2023

£100.00 dated 28/02/2023

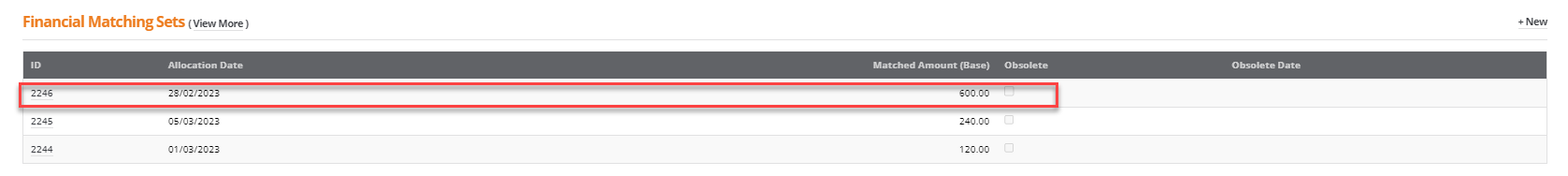

Now that there is sufficient funds receipts to settle the sales invoice in full the following matching set can be created:

The matching set is dated as the same date of the most recent sales receipt:

The fully allocated sales invoice will now appear on the VAT report displaying the original sales invoice date: