Stock Revaluations

BCE Stock Revaluations – User Notes

Purpose of this document

This document informs BCE users’ how to revalue their stock item unit prices providing illustrated worked examples for each of the revalue options.

A pdf copy of this document can be downloaded from here

Stock Revaluation Options

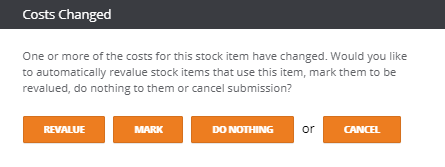

When changing the material cost of a stock item, BCE will prompt the user to take one of the following actions:

For stock items, each of the cost change actions are summarised as follows:

Revalue

Creates transactions of type StockLoss or StockGain depending on whether the material cost value is decreased or increased

Creates transactions of type PurchaseReceipt for goods not yet received

For manufactured stock items, their components having X StockItem with new calculated costs.

Mark

Creates transactions of type StockLoss or StockGain depending on whether the material cost value is decreased or increased

Creates transactions of type PurchaseReceipt for goods not yet received

Set components having X StockItem with flag - to_be_revalued to true and does not change any costs.

Do Nothing

Updates the stock items material cost and does nothing to components where this stock is used

Creates transactions of type StockLoss or StockGain depending on whether the material cost value is decreased or increased

Creates transactions of type PurchaseReceipt for goods not yet received

Cancel

Closes the ‘Costs Changed’ dialog box and no action is taken

Example Setup

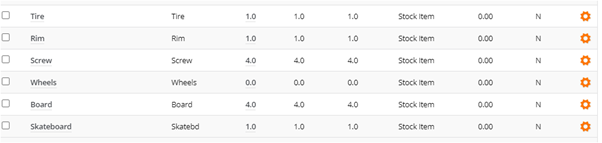

The manufactured stock items are made up of the following components:

Stock | Type | Components | Material Cost | Total Cost |

Tyre | Component Stock Item |

| 10.00 |

|

Rim | Component Stock Item |

| 5.00 |

|

Screw | Component Stock Item |

| 2.00 |

|

Board | Component Stock Item |

| 20.00 |

|

Wheel | Manufactured | 1 Tyre 1 Rim 4 Screws |

| 23.00 |

Skateboard | Manufactured | 4 Wheels 1 Board |

| 112.00 |

Purchase the following stock item components:

Stock | Material Cost | Quantity | Total |

Tire | 10.00 | 5 | 50.00 |

Rim | 5.00 | 5 | 25.00 |

Screw | 2.00 | 20 | 40.00 |

Board | 20.00 | 5 | 100.00 |

Manufacture the following stock items by creating and completing the following works orders:

Stock | QTY |

Wheel | 4 |

Stock | QTY |

Skateboard | 1 |

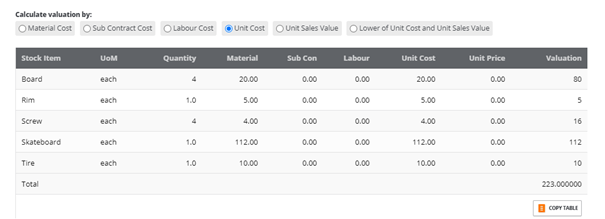

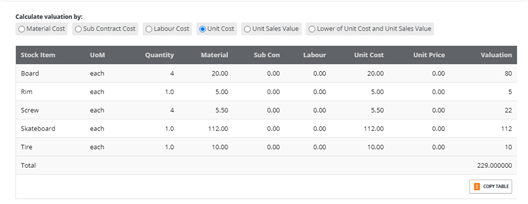

Following the manufacturing process the stock levels will be as follows:

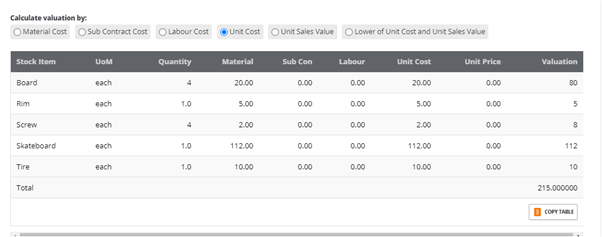

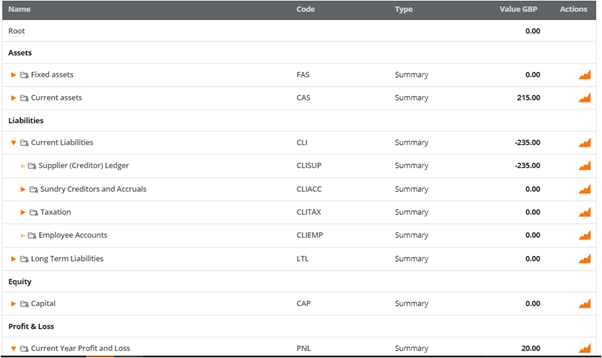

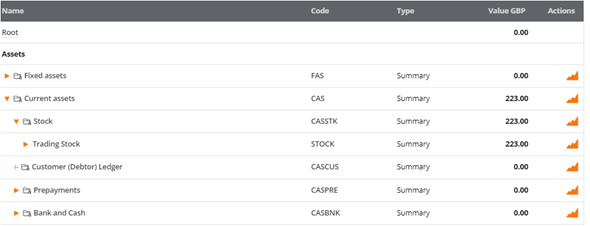

The stock valuation report records the following stock levels and associated material value that agrees with the current asset value for stock in the chart of accounts:

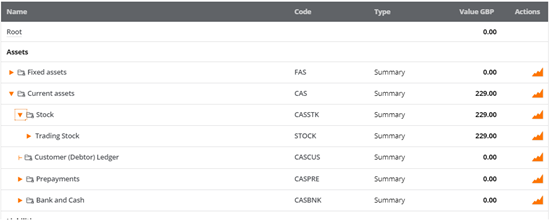

Chart of Accounts:

Stock Revaluation Examples

Do Nothing

Edit stock item ‘Screw’ and change the material cost from £2.00 to £4.00.

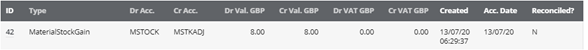

Click on ‘UPDATE and select ‘DO NOTHING’ from the ‘Costs Changed’ popup. This creates a material stock gain for the component increasing the overall stock value by £8.00 (Qty of 4 * £2.00)

The stock valuation report displays the increase in stock value which agrees with the value of stock in the chart of accounts:

Chart of Accounts:

In summary, ‘DO NOTHING’ performs the following actions:

Updates the cost value of the component, creating a transaction for the stock loss or gain

Does not update the material cost of any existing manufactured items using the revalued component

For manufactured items using the revalued component, the component cost is updated so newly manufactured items will now use the new component material cost

Mark

Edit stock item ‘Screw’ and change the material cost from £4.00 to £5.50.

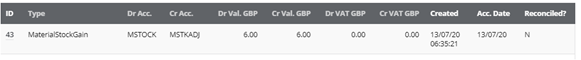

Click on ‘UPDATE’ and select ‘MARK’ from the ‘Costs Changed’ popup. This creates a material stock gain for the component increasing the overall stock value by £6.00 (Qty of 4 * £1.50)

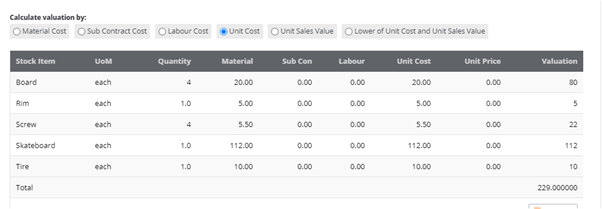

The stock valuation report displays the increase in stock value which agrees with the value of stock in the chart of accounts:

Chart of Accounts:

In summary, ‘MARK’ performs the following actions:

Updates the cost value of the component, creating a transaction for the stock loss or gain

Does not immediately update the material cost of any existing manufactured items using the revalued component

For manufactured items using the revalued component, the component cost is updated so newly manufactured items will now use the new component material cost

For manufactured items using the revalued component, sets the ‘To Be Revalued?’ tick box on the stock items ‘General’ tab. To update marked stock items, this option must now be used in conjunction with the ‘Revalue All Manufacturing Items’ process.

Creates transactions of type PurchaseReceipt for any goods not yet received.

Revalue

After changing the material cost for a stock item, the option to ‘Mark’ a stock item to be revalued sets the ‘To Be Revalued?’ tick box on the stock items ‘General’ tab. This then depends on the process ‘Revalue All Manufactured Items’ to be run to commit the changes to the manufactured items

As an alternative option, ‘Revalue’ will commit the changes immediately, removing the needs to mark items for update.

Click on ‘UPDATE’ and select ‘REVALUE’ from the ‘Costs Changed’ popup. This creates a material stock gain for the component increasing the overall stock value by £6.00 (Qty of 4 * £1.50) and increases the manufactured value:

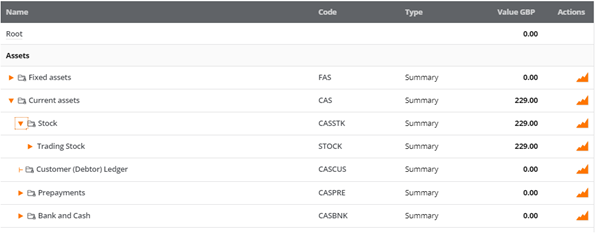

The stock valuation report displays the increase in stock value of the skateboard which agrees with the value of stock in the chart of accounts:

Chart of Accounts:

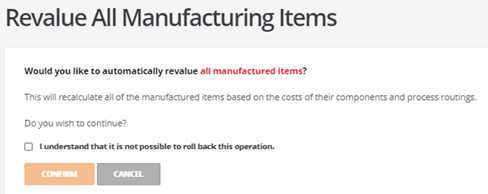

Menu Option - Revalue All Manufactured Items

For all manufactured stock of type Stock item Service Item and Kit Items when run will update their values based on their components and process routing values.

In summary, ‘REVALUE’ performs the following actions:

Updates the cost value of the component, creating a transaction for the stock loss or gain

Updates the material cost of any existing manufactured items using the revalued component, creating a transaction for the stock loss or gain

For manufactured items using the revalued component, the component cost is updated so newly manufactured items will now use the new component material cost

Creates transactions of type PurchaseReceipt for any goods not yet received