Running Payroll - Quick Guide

Introduction

This guide illustrates how to use the payroll functionality to generate employee payslips and submit RTI to HMRC.

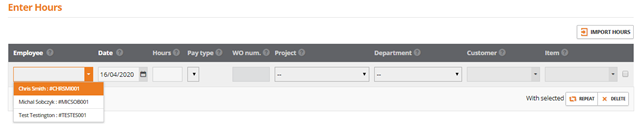

Enter Hours

From the menu select Employees, and Enter Hours.

Select New line to add the employees details.

Select the employee from the dropdown list.

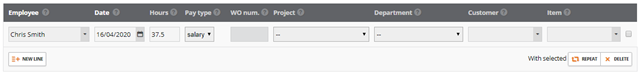

Select the date, enter how many hours the employee has worked if they are paid hourly. If they have a monthly rate, enter 1 and the correct amount will show.

Select the relevant pay type from salary, overtime or SSP etc.

Complete the works order, project, department, customer or item fields as required.

Options exist to allow lines to be deleted or repeated. If repeating a line, you are required to select a start date, interval and the number of repetitions.

After the hours have been entered you will see a summary showing the period start date, period end and the pay type, which shows salary, pay amount, hours, contracted hours and any differences in the hours.

If the details are correct, save the hours and process payroll at a later date or select individuals or select all and run the payroll now.

Running the Payroll

On entering the hours for employees select the required employees or tick Select all to select all employees.

Click Save & Run Payroll.

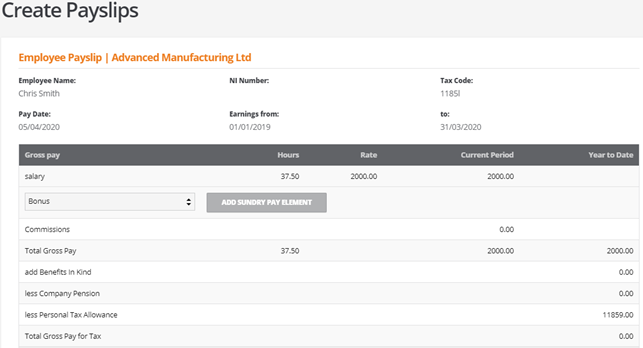

From the create payslips page, you will see the employee’s name, NI number, tax code, the pay date and the earnings from and to date.

In addition, you will see the gross pay details, hours, rate, current period pay and year to date.

Below this, any deductions and finally the net pay are displayed.

You have an option to add sundry pay elements such as bonuses. If you add any sundry pay elements, you can change the value and recalculate the payslip as required.

When ready to continue, click save and process payslips.

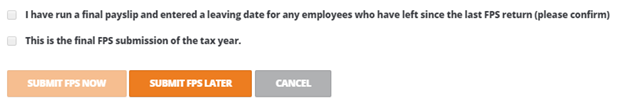

You will be taken to the Outstanding FPS submission that will be sent to HMRC.

Make any adjustments as required, select the tax year and tick one of the tickboxes which is relevant to you.

You can choose to submit the FPS now or later.

If you decide to submit the FPS later, your payslips will be saved and they can be found on the payslips page.