Processing Furlough pay

Introduction

As part of Government's Coronavirus Job Retention Scheme employers can claim 80% of employees wages if they have been furloughed.

In this guide we will show how to create a new pay element and process payslips for furloughed employees.

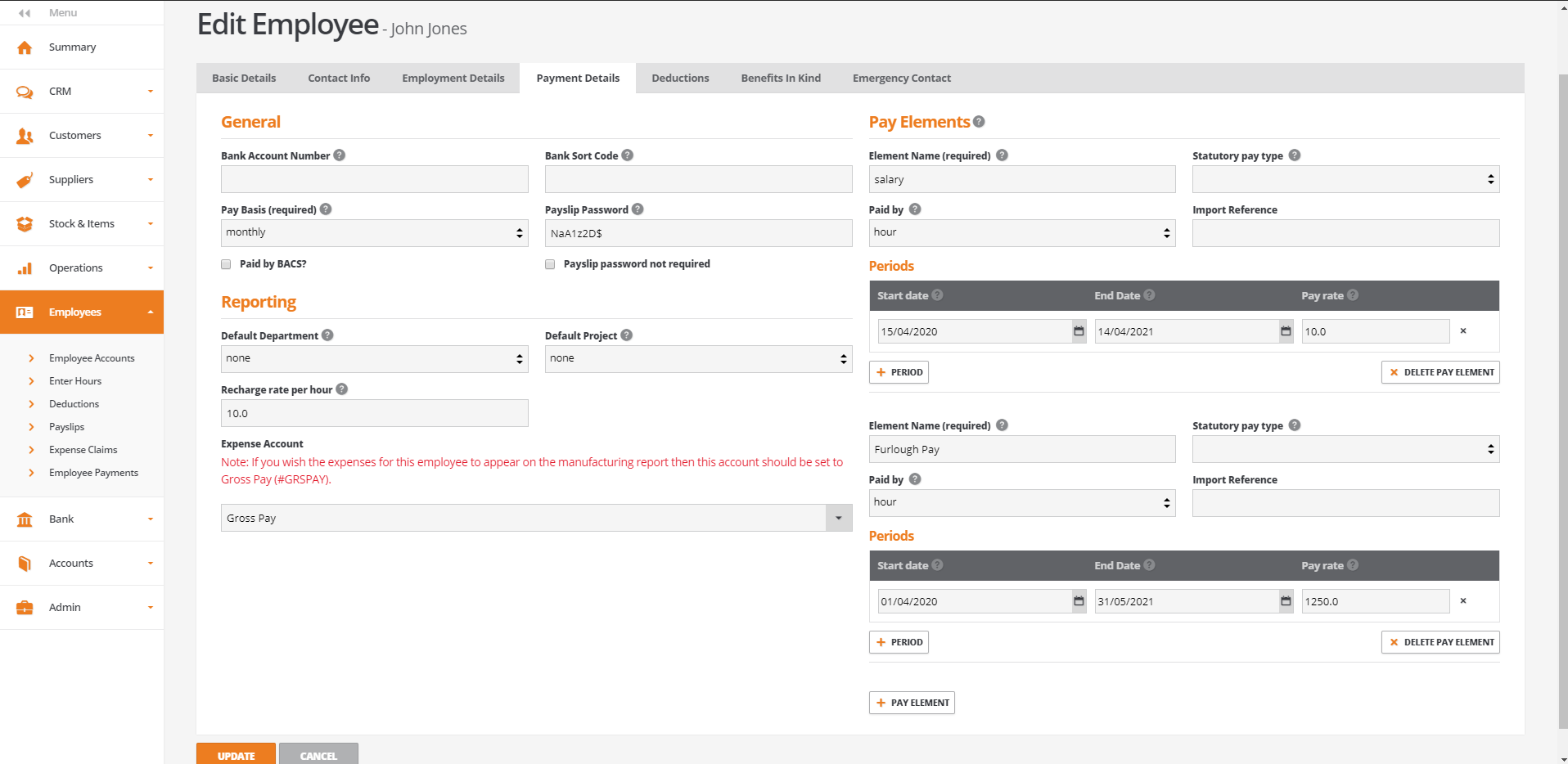

Adding furlough pay element

Same as with Government's scheme you have to first calculate the reduced wage of the employees. Once this is prepared:

- Navigate to Employees > Employee Accounts

- Select furloughed employee and go to Actions > Edit Employee

- In the Payment Details tab add new pay element in the Pay Elements column

- Name the element (for example Furlough pay), choose the period when this pay element is valid (no earlier than 19th March 2020) and input the amount calculated before

- Press Update

It is best to leave the Paid by setting as 'hour'.

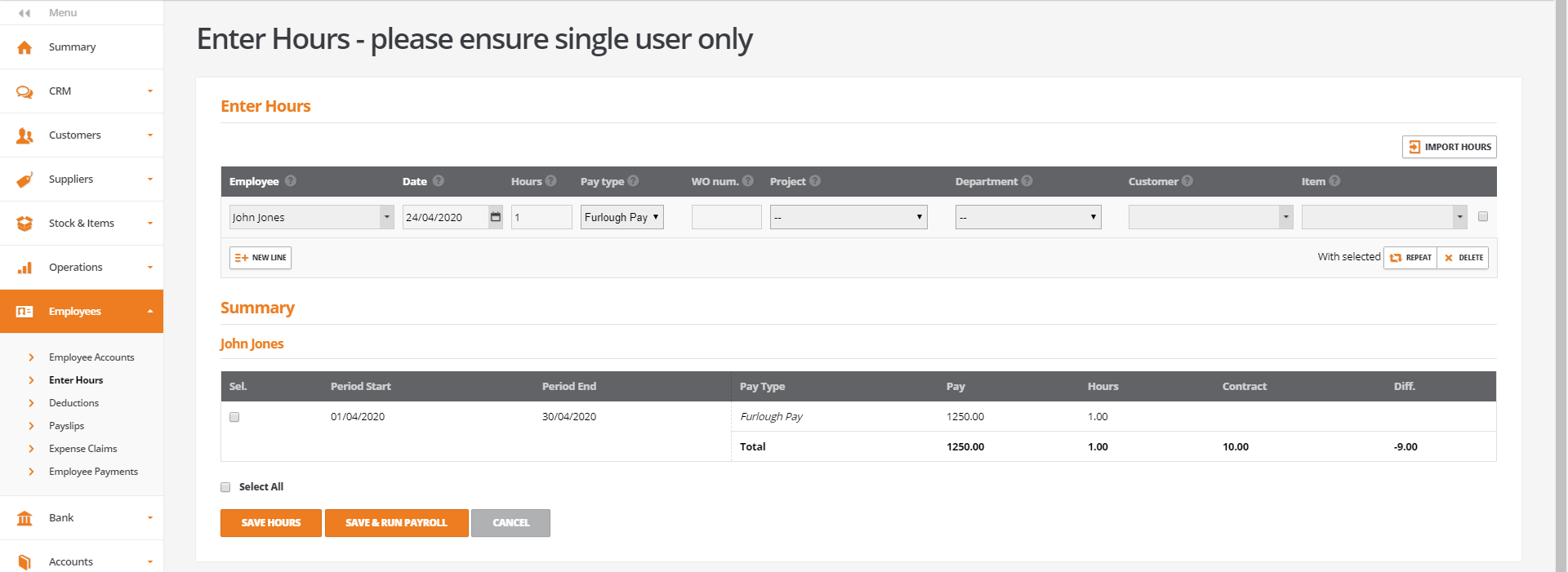

Processing furlough pay

Once all employees have their pay elements updated the payroll process is same as usual.

When entering hours choose the correct pay element from the list and put in the amount of hours worked.

If the amount in pay element was set to full 80% of employee's base salary the amount of hours should be set as '1' for monthly payroll or the amount of weeks paid for weekly payroll.