Chart of Accounts – Stock Value/Cost of Sales Accounts

Introduction

This document informs BCE users’ about changes to the BCE Chart of Accounts introducing the flexibility to permit greater analysis of stock valuation and cost of sales.

A pdf copy of this document can be downloaded from here

Related Topics

Chart of Accounts – Stock Cost/Cost of Sales

BCE v1.5.10 introduced a flexible approach to managing the chart of accounts that gave users the ability to customise their structure with greater freedom to create new summary levels and account codes. This provided better management and more detailed analysis of the chart of accounts.

Building on this approach BCE v1.7.0 removes the limitations of locked accounts for stock transactions in respect of stock cost value and cost of sales.

To complement this increased flexibility users can create stock groups where default account codes for all stock movements can be associated with stock categories to meet the individual business requirements.

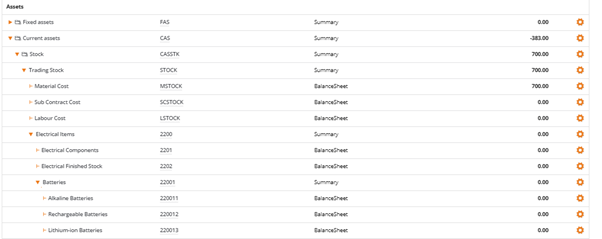

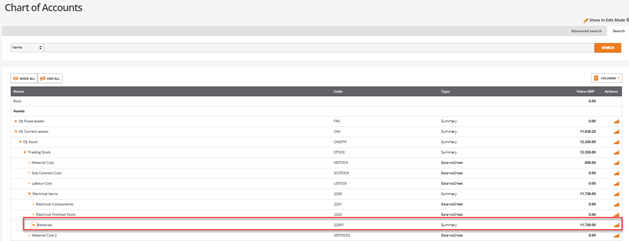

Balance Sheet – Stock Cost

From the balance sheet, within current assets, trading stock, a more defined set of summary levels and account codes can be created to record and analyse the value of stock:

Depending on the level of analysis required the original BCE default balance sheet account codes can be retained and used for the consolidated recording of stock values.

Where more detailed levels of analysis is required, any number of trading stock summary and account codes can be setup.

When the chart of account codes have been created, they can be used as defaults on stock groups and stock item codes.

See ‘Stock Groups – User Notes’

Note: Once the chart of accounts structure for stock cost value has been defined, any of the new or original default codes can be deleted provided they have not been used for any financial transactions or assigned as defaults to stock groups.

See ‘Managing the BCE Chart of Accounts’

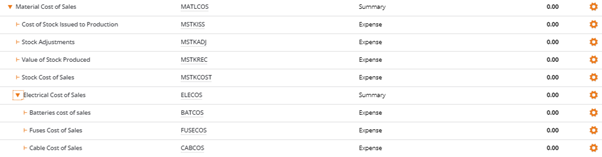

Profit and Loss – Stock Cost of Sales

From the profit and loss, within direct costs, a more defined set of summary levels and account codes can be created to record and analysis the stock cost of sales for material costs, sub contract costs and labour costs:

The default profit and loss accounts for recording stock cost of sales can be deleted provided they have not been used for financial transactions or assigned as defaults to stock groups:

Depending on the level of analysis required the original BCE default profit and loss account codes can be retained and used for the consolidated recording of stock cost of sales.

Where more detailed levels of analysis are required, any number of cost of sales stock summary and account codes can be setup for material costs, sub contract costs and labour costs.

When the chart of account codes have been created, they can be set as defaults for use on stock groups and stock item codes.

See ‘Stock Groups – User Notes’

Note:

Once the chart of accounts structure for stock cost of sales has been defined, any of the new or original default codes can be deleted provided they have not been used for any financial transactions or assigned as defaults to stock groups.

See ‘Managing the BCE Chart of Accounts’

Financial Reports

Activity Report

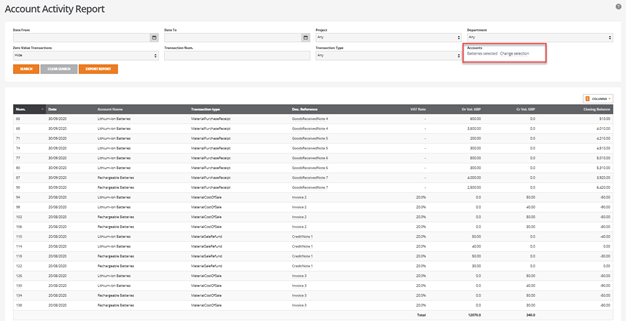

The account code activity report displays the transaction activity for the selected code:

From actions, click on the ‘graph’ icon to open the following screen:

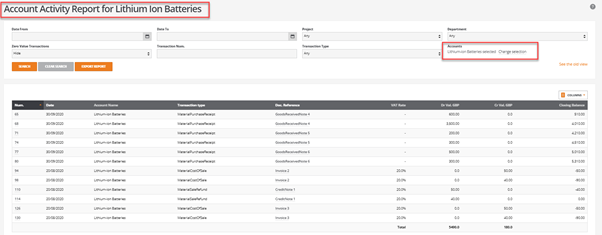

From the ‘Account Activity Report’, the ‘Accounts’ filter allows the report to be filtered by specific account codes:

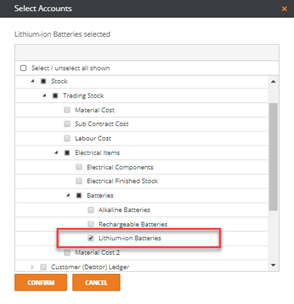

Select one or more account codes to refine the output of the activity report:

Profit & Loss Report

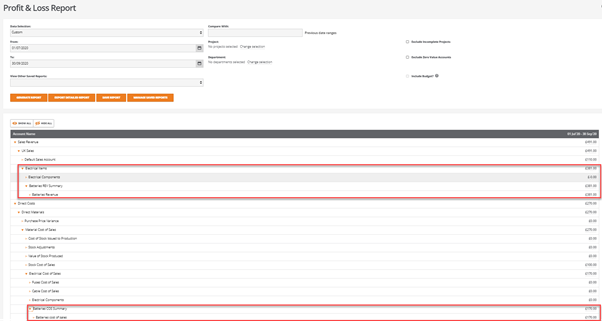

The ability to add additional account codes provides greater analysis of the profit and loss report:

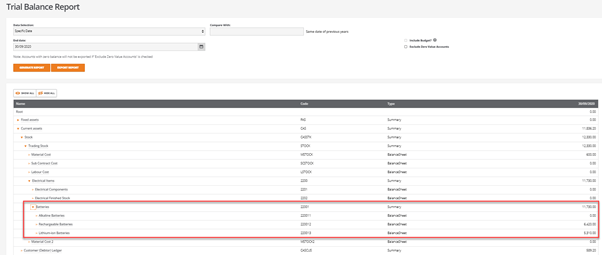

Trial Balance

The ability to add additional account codes provides greater analysis of the trial balance report: